Bitcoin extended losses below $18,000 after it breached a prior cycle’s all-time high for the first time in its history.

Bitcoin fell below a prior cycle’s all-time high for the first time ever today, breaching the $19,776 level.

The peer-to-peer currency had been struggling to maintain the $20,000 level over the past week as liquidation and liquidity woes plagued the market as lenders such as Celsius Network fell under extreme pressure.

Bitcoin has lost over 30% of its U.S. dollar value over the past week, the highest weekly loss since the outset of the COVID pandemic in March 2020 when BTC saw its price crash by 33.45% per TradingView data. Bitcoin traded below $18,000 at press time.

As interest rates rise in the U.S. at the fastest pace in decades, assets perceived as riskier by institutions and professional investors – which include Bitcoin – have fallen sharply leading to a snow-ball effect across global markets.

The Fed raised interest rates by 0.75% on Wednesday, the largest hike by the American central bank system since 1994, as inflation has kept rising over the past year. The U.S. consumer price index (CPI) for the year ended on May 2022 came at 8.6%, higher than the month before (8.3%) and representing a new 40-year high.

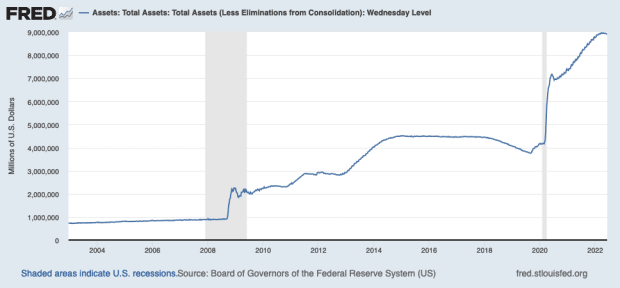

While interest rates rise, the Fed’s balance sheet has begun shrinking. The central bank announced last month that it would start a period of quantitative tightening on June 1, reducing its asset purchases and holdings – a spin on the policies it had embarked on years back.

Notably, Bitcoin has thus far existed in a period of growth of the Fed’s balance sheet. Since 2008, at the outset of the subprime crisis, the central bank began aggressively bloating its asset holdings. It remains to be seen what will happen with the P2P currency as the Fed tightens.