The bloated modern State’s existence depends upon the control of money creation, and Bitcoin will expose that.

This is an opinion editorial by Ulric Pattillo, contributor at Bitcoin Magazine and co-author of the Declaration of Monetary Independence.

Author Disclaimer: The following work is a combination of real world commentary and fan fiction, similar to your favorite sci-fi world. I do not intend to infringe or misappropriate any real world ideas or work. Any similarity to concepts or work in the fan fiction portion is purely coincidental. This is Part 2 of a series I call “Bitcoin: What-If?”. Marvel can’t own that, right?

What If … The State

The State as an institution has failed the individual. This is not to place the blame on one party nor “the current administration.” This issue is not rectified by “voting for the right people” or “educating our leaders.” Additionally, the services and agencies employed by elected and unelected officials cannot persist in a future with Bitcoin.

Analogous to the arguments in finance, hyperbitcoinization is not simply adding Bitcoin to the current fiat networks; rather it must be a completely alternate system with the sound money being the dominant unit of account in the world. Bitcoin as a completely trustless and voluntary monetary network conflicts in principle with a system that intermediates and coerces against the incentives of the individual participants in the world at large.

The State, contrarily, exists not by voluntarism or the will of the participants, but the act or threat of violence. Without this feature, The State has no way to generate revenue. The State does not create value, but takes it away in one of three ways: taxation, monetary expansion and confiscation.

Taxation, while portrayed as the upstanding duty of the citizen, is a nothing more than a veiled form of fractional slavery. If one were to be taxed 100%, you would own none of your work and would have no way to acquire property yourself, no different than a slave of times past. If a statist counters that taxes are the fee to live in the domain, then it is then true that there is no such thing as “public property.” If I am a part of the public, why am I paying someone else for what I already own a share in? If taxes are a fee, at what point have I paid that fee in full or may decline the services provided from said fee?

“Taxation is a proclamation of one’s slavery to the kings of this earth. It is a celebration of one’s ownership by a master other than God.” — Anonymous Bitcoiner

Monetary expansion is when someone exercises their unique right to decree more units of money to be created. As government power has grown to the point where it is now too big to exist, this strategy for sustaining must occur. While Keynesians will mock and dismiss this fear from their ivory tower of privilege, their ideal 3% inflation just means 3% of your buying power is stolen annually and given to the group of the thief’s choosing. Maybe it’s cronyism where those benefits are funneled to wealthy corporations. Maybe it’s a welfare state and reallocates wealth to people who are incentivized to refuse work. Maybe it’s a communist state, where the new money is divided amongst the coffers of inefficient government agencies. Whatever combination of those cases, the victims are the value creators in society. The laborer’s rightful fruits are stolen by manipulating their expected share of the value in the economy without their consent.

A third way of theft is direct confiscation. When the need arises, governments will use their monopoly on violence to lay claim to the rightful property of their citizens. It is hard for privileged Americans to imagine consequences of incarceration or death to resist such an encroachment of natural rights. Is the concept of property now a facade due to complacent citizens that sold all their freedoms to the government for the state-sponsored drug of security? It continuously happens around the world, yet news media conveniently do their best to minimize their criticality.

This is antithetical to Bitcoin, also known as “the money for your enemies.” Freedom advocates lose their legitimacy without Bitcoin as that centerpiece by leaning on a centralized monetary network. These false witnesses imply we must trust a third party to preserve that freedom. Bitcoin is trustless, so why rely on someone else to allow you to make an economic decision when that may contradict their own incentives? This is a real problem all over the world, and if human nature is true, without Bitcoin, it will come to America too.

This trustless dynamic is infinitely more important than funding an institution that does not create value. Who will maintain roads? Adopt-A-Highway is literally a small-scale version of a voluntarism-world of the future. Only a veiled sense of government relevancy stands in the way of privatized roads. Payment for usage of roads are already using transponders in the fiat world. Seems like a no brainer for the Lightning Network. What about the fire department? Voluntary firefighters are and will always be a thing. 722,800 (67% of total, USA) firefighters were volunteer firefighters in 2019. They could be paid for their commitment by communities as easily as the police described in the Bitcoin future above. What about the millions of government workers? In a true free market, if a task is necessary, it will be filled. Perhaps that will expose millions of unnecessary jobs (details below) and relocate them where the free market actually dictates. In a Bitcoin world, we do not have jobs for the sake of having jobs like the communist MMT lie that so many economic elite champion and the unlearned buy into.

Death And Taxes

“Only two things are certain in life: death and taxes.” Bitcoin fixes this. An institution with a monopoly on violence and money creation can levy taxation and monetary debasement on the people. The only options are acceptance or rejection. To reject is to refuse to use or marginally participate in the fiat economy. This was not a realistic possibility until Bitcoin came about, acting as the first significant external economic force since gold’s legitimacy was abolished in 1971.

The state institutions around the world must now count the costs of digital and decentralized hard money adoption or maintain the status quo of limitless currency. Some would say, “bitcoin benefits everyone.” To those I would ask, “Does it benefit the giant when Jack stole away his gold egg laying fowl?” Governments have a remarkable technology that essentially is a goose that lays golden eggs, but the eggs are also stuck on an inescapable track whose speed can be shifted, entirely shut off or even block participants. Who in their right mind would give up that power? Fiat can be weaponized, manipulated and bent to the will of its issuer. For any ruler, Bitcoin is a clear loss in net power. To adopt a hard money with no intrinsic controls means a nation intends to act in its best interests mathematically. Their actions must elicit a net positive value.

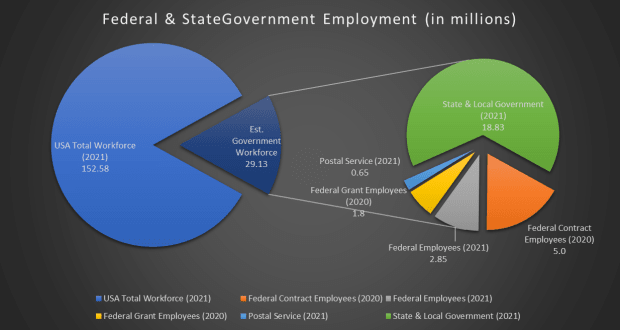

What is given up in authority is made up in efficiency and stability. For The State, one of the most glaring signals of its inefficiency is the obscene size of the bureaucracy. Nearly 20% of all Americans in the 2020-21 were employed by the government and funded via monetary expansion and did not participate in free market competition. These agencies cannot hope to maintain employment numbers if the government cannot create money to pay them.

Bitcoin, as the next evolution of cash, creates a burden of identifying pseudonymous commerce on a shrinking government. Under a hard money standard, it would be very hard to convince another 87,000 agents to work for IOUs from the IRS. Compounding that shrinking reach with pinpointing tax responsibility within a complex, pseudonymous Bitcoin network, causes theft via taxation to be multiple times more difficult. Hyperbitcoinization suffocates The State, disabling the parasitic action of stealing from value-creating transactions. Bitcoin is more akin to cash than checking or credit, so the ability to audit the network for such obligations would be a bigger cost-burden than the potential returns. Any revenue in taxes to the cumbersome state would turn into a voluntary donation. Donations cannot keep a bad actor alive. The State cannot forcibly take bitcoin. Every time a state actor would attempt to freeze or confiscate from third-party custodians, they would drive thousands of more people to self-custody. Every bitcoin spent by The State puts money back in the hands of value creators who will remember when The State tried to attack their ability to trade.

There Is No Second ₿est

Bitcoin is designed to take the place of not only the fiat monetary unit, but the institutions that drive it. The dollar as we know it battles for the same place on the food chain as Bitcoin. If Bitcoin were to succeed as a monetary network for the people, this would disable the dollar and other fiats from all the things we have accepted as normal: illicit sanctions on commoners, monetary debasement and bordered payments.

“There is no second best.” Every other option gives away your ability to exist if you disagree with the owners of your domain. Do not fall for the facade of public property or voting rights. The powers in this world have not acquired such status by giving normies options. Bitcoin denies elites the ability to co-opt its network. The only option is to participate honestly or destroy the internet entirely. Bitcoin is literally essential for true freedom going forward. To opt out of Bitcoin is to opt into a slave economy. Which is it going to be for you?

This is a guest post by Ulric Pattillo. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.