While many bitcoin investors look for the asset to behave as a safe haven, bitcoin typically has ultimately acted as the riskiest of all risk allocations.

The below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox,

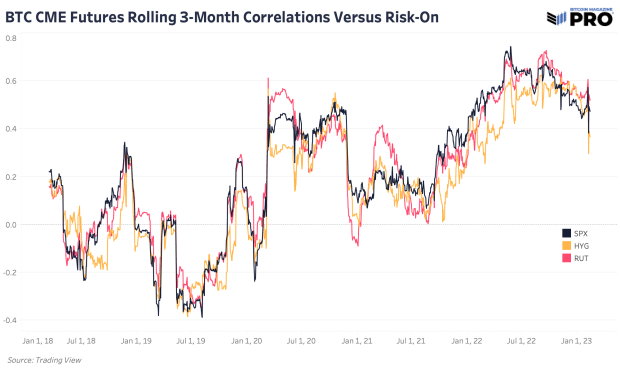

Looking at the rolling 3-month correlations of bitcoin CME futures versus a few of the risk-on indexes mentioned above, they all track nearly the same.

Although bitcoin has had its own, industry-wide capitulation and deleveraging event that rival many historical bottoming events we’ve seen in the past, these relationships to traditional risk haven’t changed much.

Bitcoin has ultimately acted as the riskiest of all risk allocations and as a liquidity sponge, performing well at any hints of expanding liquidity coming back into the market. It reverses with the slightest sign of rising equities volatility in this current market regime.

We do expect this dynamic to substantially change over time as the understanding and adoption of Bitcoin accelerates. This adoption is what we view as the asymmetric upside to how bitcoin trades today versus how it will trade 5-10 years from now. Until then, bitcoin’s risk-on correlations remain the dominant market force in the short-term and are key to understanding its potential trajectory over the next few months.

Like this content? Subscribe now to receive PRO articles directly in your inbox.

Relevant Articles:

- A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global Liquidity

- The Everything Bubble: Markets At A Crossroads

- Just How Big Is The Everything Bubble?

- Not Your Average Recession: Unwinding The Largest Financial Bubble In History

- Brewing Emerging Market Debt Crises

- Evaluating Bitcoin’s Risk-On Tendencies

- The Unfolding Sovereign Debt & Currency Crisis