Bull Bitcoin: The Cypherpunk Bitcoin Exchange

Proving that custodial, centralized, altcoin casinos are not the only way to succeed in this industry, the privacy-focused bitcoin exchange Bull Bitcoin recently went multinational, bootstrapping a team in France and expanding its services to the whole eurozone. The move comes only a year after announcing their expansion into Costa Rica.

“Bull Bitcoin is probably the longest-running Bitcoin-only, self-custodial exchange,” Theo Mogenet, Europe General Manager for Bull Bitcoin, told Bitcoin Magazine in an interview.

”When you buy Bitcoin from us, it goes straight to your wallet, we never hold client funds—and it reflects Francis’s vision of privacy and the cypherpunk ethos.”

https://x.com/Bull Bitcoin_/status/1881371651251769619

Founded in Montreal, Canada, in 2013, Bull Bitcoin’s primary claim to fame is its noncustodial exchange model. Rather than take your fiat and credit a bitcoin balance to your account on their books, Bull Bitcoin forces users to input a Bitcoin public address before purchase. This ensures that when fiat lands on their account, they can quickly pay out the bitcoin to the user’s wallet of choice.

They’ve also been early and active supporters of the Lightning Network and Liquid Network, and have even integrated PayJoin into their platform, all of which offer significant privacy benefits to their users.

Finally, they have developed a line of products focused not on trading and speculation but on using bitcoin as money.

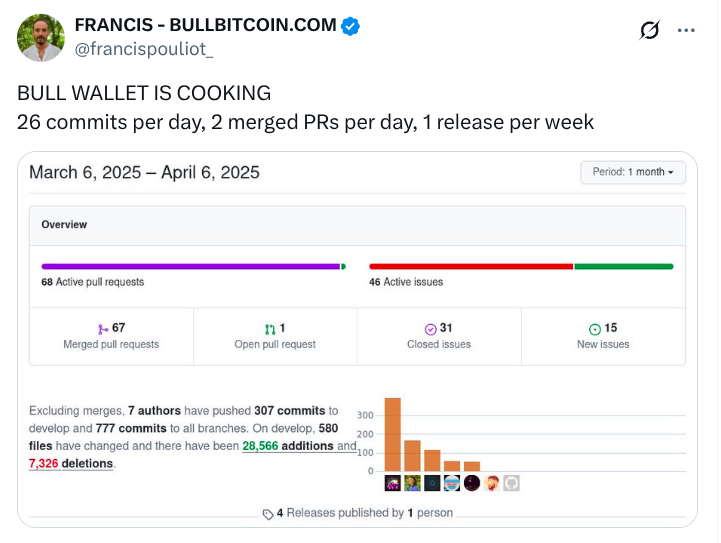

Bull Bitcoin enables users to pay their monthly bills with bitcoin such as rent, electricity, data plans, and as of late even buy real estate. They also have a Bitcoin wallet app that is still in its early stages, but is quickly gathering a strong list of features.

One subtle but powerful difference between Bull Bitcoin and most other exchanges is their bitcoin-only stance, which rejects selling altcoins that are the bread and butter of most exchanges — monetizing the speculative fervor of the crypto markets.

Bull Bitcoin ignores the whole crypto market, focusing only on bitcoin, which allows it to deploy cutting-edge technologies before many of its competitors. The team at Bull Bitcoin thereby doesn’t run the compliance risk or carry technical debt that comes naturally with supporting hundreds of different altcoins.

The result is a profitable company with a lean and mean team that has now gone international.

Privacy is Not a Crime

The final piece to Bull Bitcoin’s success might be its founding story. Started by French-Canadian entrepreneur and Bitcoin Maximalist Francis Pouliot, the company has been entirely self-funded, receiving no VC money so far.

While sticking to the early cypherpunk vision of bitcoin as sovereign money could not have been easy, it has enabled the company to make decisions and employ strategies that other exchanges often avoid.

Now, they are entering the EU in an era where many other cryptocurrency businesses are exiting the union. Companies like Deribit left Europe years ago and even giants like Tether are being squeezed out from the European Union due to regulatory pressure. Bull Bitcoin has instead dove in, seeing an opportunity to reach an underserved market.

On the compliance front, Bull Bitcoin has taken a very different approach than other market participants. Rather than over-comply out of an abundance of caution as seen with many crypto exchanges, they have stuck to the letter of the law, and looked for ways to defend their users from overzealous regulators or politicians.

“We have a lot of experience dealing with the government. We come from Canada so we are used to government oversight. The compliance burden of the European Union, although much higher than Canada, doesn’t scare us,” Francis Pouliot told Bitcoin Magazine.

Theo Mogenet added:

“We have certain obligations in terms of fighting money laundering — that we cannot really circumvent. But as you mentioned, when, for example, a government, be it in Canada or here in Europe, will ask for a bulk of transactions without any judicial mandate, without any legal basis to do so, our policy is just to fight back and make sure that we can use every piece of legislation that is out there — to basically push back on the government’s demand.”

Expansion into Costa Rica

Bull Bitcoin’s expansion is not limited to Canada and Europe. In recent years, Bull Bitcoin started making inroads into Costa Rica, marking their entrance into Latin American markets, an ecosystem often driven by peer-to-peer payments and low-tech infrastructure.

Becoming the first “Bitcoin exchange in the country,” it quickly integrated with the very popular mobile text payments service SINPE Móvil, allowing users to trade sats for fiat quickly and in a way the local population was familiar with.

The result seems to have been a quick expansion of adoption among farmers markets and other produce retailers, which often feature videos from Francis and the team, enjoying the Central-American weather.

The move to Costa Rica was famously driven by an escape from the Covid restrictions in Canada, which Francis protested and opposed.

Bull Bitcoin soon partnered with the Bitcoin Jungle, an open source grassroots effort similar to the Bitcoin Beach community in El Salvador, which maps and educates Costa Rican locals on how to benefit from bitcoin and leverage it as a money and ecosystem.

The Burdens of Self-Custody

Bull Bitcoin’s commitment to cypherpunk values has not come without challenges. Self-custody in particular, while removing a great burden from the company in terms of compliance and security risk, demands a more educated user base and very responsive support team.

Boasting a self-hosted “simple chat system” for customer support that even Francis himself will at times run, the approach allows users fast and reliable access to a savvy Bitcoiner who can give them a quick turnaround, without relying on third party platforms.

“In our case, it’s a self-hosted permanent chat. So it’s running on our servers. Like no client data is shared with outside parties. And you will basically chat with a human, usually like, for example, in Europe, it would often be me or Jimmy or customer support officer. Sometimes it’s even Francis that is answering to clients,” said Theo Mogenet about their customer support process.

They have processes designed to help prevent users from getting scammed as well, going as far as to calling their users when they are in a customer support track.

“We can also have like a 10-, 15-minute conversation with them to make sure that they know what a Bitcoin wallet is, what the risks with self-custody are to be sure that they are not pressured or pushed by someone to do that,” Theo explained on the podcast.

Phishing scams are a common issue for Bitcoin and crypto exchanges, and naive users get talked into buying crypto to send to scammers, in order to relieve pressure from various lies or pressure tactics.

Besides their active support team, in 2022 Bull Bitcoin acquired Veriphi, a “white glove service provider for Bitcoin self custody”. The firm had deep roots in the Bitcoin Quebec scene and developed a lot of experience with advanced self-custody consulting.

Today, this service is integrated into their product line with a dedicated website at bitcoinsupport.com, offering users a range of consulting and education packages to move them along the journey into bitcoin self-custody with proper guidance.

Self-Hosted Infrastructure: The Fork War

The focus on self-hosted infrastructure did not come from a place of ideology alone, but was a hard-earned lesson from the 2017 Bitcoin fork war—the internal conflict within the Bitcoin industry about what path Bitcoin scaling development should take and who got to decide this.

In a 2017 speech, for example, Francis Pouliot explained the dilemmas the Bitcoin community faced at the time, the game theory of economic nodes, and the thesis of Bitcoin consensus that ultimately emerged victorious.

Faced with a faction of the Bitcoin community called Bitcoin Unlimited that wished to scale Bitcoin by increasing the block size—a technical option rejected by Bitcoin Core developers at the time—Francis Pouliot and the Bull Bitcoin team led an effort to educate and rally Canadian Bitcoin businesses against the proposed hard fork, as seen in this letter of intent from 2017 signed by 16 Canadian businesses.

Bull Bitcoin also began building Cyphernode, a “modular Bitcoin full-node microservices API server architecture and utilities toolkit to build scalable, secure, and featureful apps and services without trusted third parties.”

This software suite, launched as open-source software a year later, allowed Bull Bitcoin and associated companies to take a stand in that schism with software they had full control over, enabling them to choose which version of Bitcoin to signal support for and which version of Bitcoin to follow in the event of a contentious bifurcation of the network.

That software independence would prove useful against another front in this culture war: a corporate alliance of mining pools, data service providers, and exchanges that would soon join the fray and pursue a different consensus change to the Bitcoin protocol, known as the NY Agreement, which supported a version of Bitcoin called SegWit2x.

The mighty corporate alliance included giants such as Blockchain.com, Coinbase, and 50 others, including mining pools that on paper had more than 80% of hashing power behind them, yet also challenged developer and community consensus.

Both Bitcoin Unlimited and the NY Agreement coalition would end up losing this fork war to community and developer consensus, who used tools similar to Cyphernode (UASF) and stood behind the backwards-compatible SegWit soft fork, a scaling solution for Bitcoin that maintained consensus with older versions of Bitcoin and would eventually prove victorious.

Bull Bitcoin’s role in defending the decentralization of Bitcoin in 2017, alongside their alignment with cypherpunk values for over a decade, places them comfortably as legends in the annals of Bitcoin history.

This post Bull Bitcoin: The Cypherpunk Bitcoin Exchange first appeared on Bitcoin Magazine and is written by Juan Galt.