This article is featured in Bitcoin Magazine’s “The Withdrawal Issue”. Click here to subscribe now.

A PDF pamphlet of this article is available for download.

“It is not that humans have become any more greedy than in generations past. It is that the avenues to express greed have grown so enormously.”

– Alan Greenspan

140 Broadway, the corporate HQ of PaineWebber; the year was 1983 and Wall Street was still withdrawing from a 16-year bear market. Brokers were working as cab drivers and night school teachers to feed their habits when suddenly, with a fresh hypodermic jab of cash from the Fed, the bear turned into a bull and everybody got addicted to stocks again.

Nobody saw it coming, except Marty Zweig who wrote a piece in Barron’s that some say marked the scabby bottom. Now huge bales of cash were being snorted every day on the narrow street in Lower Manhattan that starts at a cemetery and ends in a river.

At the trembling and tremors of a bear market bottom, the offices of PaineWebber were littered with burnt-out, coupon-clipping geriatrics getting carried out on stretchers after every price slam. But the dead started dancing when the bear turned into a bull.

Into this feverish “boardroom”, as the sales floor with 50 desks and phones was called, poured an avalanche of twenty-somethings anxious to make a killing, already hooked on narcissism.

The virus of insta-riches on Wall St had been absent since the 1960s go-go years and the Nifty Fifty, spread throughout the land attracting misfits, oddballs, and grifters who had trouble fitting into society but wanted to be part of the establishment nevertheless. The bull market was young and untrusted, just like this crop of weirdos and junkies.

The “wire houses” like Smithy Barney, Shearson, EF Hutton, and Merrill Lynch, is where a new sobriquet, “Yuppies” — Young Urban Professionals — was born. They pickpocketed the zeitgeist from the preppies. Lacoste shirts were out; power ties were in. So was working the phone, incessantly calling “Mr. Jones”, the prototypical prospect on the other end of the phone to pitch stocks.

I was one of these new recruits. I had been an aspiring comic working the nascent comedy club scene in NYC by night, and sleeping through NYU Tisch School of the Arts by day. I grew up in the suburbs of Westchester County in the time of Billy Joel, the Bee Gees, and Harvey Wallbangers.

I moved to Manhattan and lived in a few different apartments. My current digs was a brownstone on Gramercy Park East, the building with two stone lions out front. I got picked up in Washington Square Park one day by a nymphomaniac named Gigi who liked to pop uppers. She took me back to her mom’s Gramercy Park apartment and knocked me out with her vaginal impulse. Around three o’clock in the morning, we took the edge off with some soft shell crabs from Citarella and a pitcher of dirty martinis with Gin. This was my base for a while. Just me, Gigi, her mom, and a cat named Stinky.

I was working minimum wage jobs to support my comedy habit; an usher at Radio City Music Hall, a proofreader at the Samuel H. Moss rubber stamp factory on 23rd Street, and a telemarketer at Campaign Communications Institute on 57th, selling Montgomeray Ward auto insurance, vitamins, and Republican political contributions.

Then one day I followed up on a lead for a job and walked into the PaineWebber office at 140 Broadway and started working for an ex-Lehman broker named Geoffrey J. Throckmorton III. Geoffrey “Triple Sticks” they called him.

Geoffrey handed me 800 bucks and told me to see his friend at Moe Ginsburg on 5th Ave. and 21st. Two hours later I had two pinstripe suits, an extra pair of pants, three shirts, four ties, a pair of wingtips, and a natty white pocket kerchief to tuck into the breast pocket of my new suits.

The next day I started dialing for dollars, hunting for prospects for Geoffrey to pitch. A few days later, the office sales manager handed me a stack of practice exams for the Series 7 licensing test and told me to memorize the answers.

Six weeks later, I passed the Series 7, was assigned a desk, given a six-month draw against commissions and a box of S&P cards with the names and numbers of leads and a copy of Martin D. Shafiroff’s “Successful Telephone Selling in the ‘80s”. Marty was a big swinging dick on Wall Street at the time, who was making $1 million a month over at Lehman Brothers. The guy who shined his shoes, a Haitian named Two Tone Tommy had a gift for gab. Marty gave him a desk and a phone, and he became a million-dollar producer in less than six months.

The race was on to get as stinking rich as possible as fast as possible. I opened my first account; 20,000 shares of Nippon Steel at 80 cents a share. A month later, I had sold over 1 million shares of Nippon Steel to 40 new clients. I was salesman of the month. I was annualizing at about 20,000 percent higher than my rubber stamp factory job. I was hooked.

Stock-brokering agreed with me. Come and go as you please. Say absolute rubbish on the phone. Close deals. Get paid big bucks and hang out at Harry’s on Hanover, the Pussycat Lounge, maybe Billy’s Topless on 24th, or Jeremy’s on Front Street that had sliced-off neckties hanging from the ceiling like stalactites, while the beer came in Styrofoam cups bigger than basketballs. The Pyramid Club on Avenue A is where Gigi liked to orgy it out with her drag queen friends and tourists from Australia — then maybe an after hours joint like The Red Door. At 7 a.m., it was back to the office and the whole thing started all over again.

The next hundred months were spent in a drug and alcohol induced blackout. And here’s where the story really gets interesting.

My desk mate at the firm was a guy named Denede Wickham.

He was also an NYU grad, a business major. A black guy who smoked a pipe all day filled with Borkum Riff and Lebanese hash.

He was already a top producer at the firm. In his first few months on the job, he set up a desk inside Grand Central Station without telling anybody and opened 200 IRA accounts in a month. Management was so impressed they made him sales manager.

He lived by a basic philosophy. He said that the mind was always in a battle between love and fear. In fact, the mind was like a biological specialist on the floor of the NYSE making a market in the funky reality between love and fear; a constant process of emotional price discovery and self-discovery. Fear was always up; love, not so much.

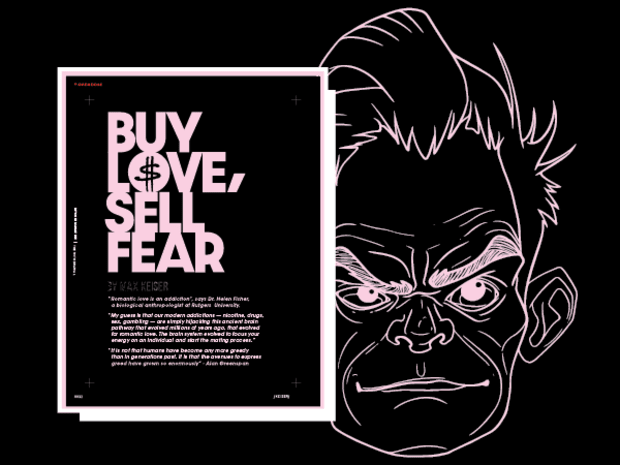

Denede said that all the world’s minds were connected in an intergalactic superconsciousness and the battle between love and fear was taking place globally all the time and it defined us as a species of heavy thinkers looking for love and avoiding pain. He summed it up simply as, “Buy love, sell fear”.

He mastered his own fear- and love-torn mind like a zen master meets Martha Stewart. It kept the positive vibes flowing his way.

Denede always had a bindle of blow on him. He got through NYU selling weed on concession that he bought from the Rastafarians in Washington Square Park. He was the biggest volume seller of weed at the NYU dorms.

He never sold coke though, because that would have encroached on “Jersey John”, aka J.J., who lived in the Weinstein dorm penthouse on 10th Street. He was mob-connected and sold a ton of coke from his dorm room. The NYU guard downstairs was in on it. So was the couple of NYU professors who lived on the 8th floor.

A rope was lowered to the street from his window and several kilos of blow was hauled up every Wednesday night to serve the weekend crowd. Denede stuck to weed. “If you need weed, call Denede”, was his motto.

Denede grew up in Charleston, South Carolina. He bought a building on 145th Street and Broadway. On the ground floor was a candy store called the “El Coqui” that sold pre-rolled joints sprinkled with PCP, “for flavor”. Across the street was a Red Apple grocery store that sold pig ears wrapped in plastic and Brand’s Liquor, with their perpetual “Wine Riot” sale.

Denede hoped living uptown meant he might someday meet Gil Scott-Heron, his hero. He never did, but he got mugged once on Adam Clayton Powell Boulevard and ended up swapping the guy a joint for some stolen gold cufflinks. His Wall Street career started selling weed and blow to brokers, especially to Drexel Burnham Lambert who, based on his research, did more coke than anybody.

One of the brokers at Drexel set him up to take the Series 7. Then he bounced over to Merrill Lynch for a few months in their training program before jumping to PaineWebber for a big up-front bonus. He was the top producer in the office. He had lunch occasionally with Don Marron, the CEO, in the top-floor dining room. Marron would later change the course of history in Switzerland by selling PaineWebber to UBS and opening up the entire country to U.S. banking laws. This killed the whole anonymous, numbered accounts market that Switzerland was famous for.

Denede had the pick of the IPOs that the firm was underwriting. Hedge funds threw money at him every day. He was having sex with the office manager’s secretary, so anybody looking to open a new account — “Walk-ins” they were called — went straight to Denede.

He said I could crash at his building, so I took him up on the offer. I was commuting from 145th Street to the World Trade Center on the 1 train and was the only white guy in a suit and tie when we left the station uptown. By the time we got downtown, the ying-yang had flipped and there was maybe only one black guy in a sea of crackers.

Denede had another guy living in one of his apartments, a transit cop named Charles Bouche who liked to show up at 5 a.m. with bags full of drugs he confiscated from “perps” in the bowels of the NYC subway. He liked to clean his guns at 5 a.m., snorting lines of blow and Courvoisier off his fingertips, telling stories of busts gone wrong, and hanging out with tweaked ambulance drivers at Port Authority, as well as committing various felonies himself from time to time.

During one particular 5 a.m. blow fest, hanging out with the fellas, some hard home-truths were spun.

J.J., Jersey John, on his way back to Manhattan having just crossed the George Washington bridge, stopped by Denede’s on his way downtown.

John had some mini, remote-controlled, executive toy dump trucks and earth-moving equipment with him. He pulled a mirror off the wall and laid it on the table, dumped a huge pile of coke on the mirror, and gave us each a remote control. The idea was to see who could move the most coke around the mirror with the Tonka toys.

“Withdrawal is something everyone is dealing with all the time, while simultaneously getting addicted to something else”, Denede opined.

“Fetishes always warp our minds and end up defining us, for better or worse. The most anyone can do is pick your addiction and so, pick your withdrawal.” Denede fell deeper into the rabbit hole of his cerebral sanctum, aided by J.J.’s cocaine development project on the mirror.

“Withdrawal is inevitable, as the sun sets and fish bite. Withdrawal is unavoidable. We are driven by our unhinged passions and we are punished by the unmerciful detachment that follows.”

J.J. poured himself a Johnnie Walker. Denede snorted his initials in blow he had spelled out on the mirror using the Tonka trucks.

“After 500 years of trial and error, the world settled on trading pieces of worthless paper as the mechanism to exert control and influence over our fellow man. That’s the predominant addiction of the world today; unbacked paper claims on nonexistent collateral concatenated into being by unscrupulous barons on Despicable Street. Brokers swap worthless bits of imaginary derivatives, and whenever the shit blows up, the Fed, that rat Greenspan, lowers rates and resets the game giving everything and everybody a longer maturity and lower coupon. Moral hazard as a business model. It’s extend and pretend all day for whitey… deaths of despair and plastic sex dolls for everybody else.” Denede was just getting warmed up.

He continued, “The medieval priests asking how many angels can dance on the head of a pin writ large by trying to figure out how many tranches of worthless derivatives you can shove into a worthless CMO”.

“Slavery’s chains come in stacks of 10s and 20s, but it’s slavery just the same”, chimed Bouche, while cleaning his service Colt-45 revolver and Glock.

“My sister Nell got bit by a rat, and whitey’s on the moon”, Denede quoted Gil Scott-Heron.

“Feudalism never died… It took a breather”, J. J. muttered.

“Alchemists never went away. They work at the Fed now. Slavery never disappeared, we call it taxes. The fetish for power, drugs, and sex still rule using coercive violence and unbacked paper claims”, Denede bellowed. “Buy love, sell fear; it’s the cycle of addiction and withdrawal. Only the ebb and flow of the mind-specialist making a market in your head can deliver true peace. The ipso facto of being. Hanging by a thread in this cerebral cortex ghetto machine.” Denede mellowing a bit continued, “Withdrawing from your momma’s tittie. Jumping into the hellscape of puberty and withdrawing from childhood. Getting addicted to ego-centric narcissism of teenage life. Then getting addicted to aspiration, to materialism”.

And this is it. This is where this story began, if you recall. The birth of the bull market addiction that had started up again after a long, 16-year hiatus, and how the twin drivers of civilization — greed and curiosity about our existence — started a new cycle of addiction.

The last unfed junkies were konking out on the street on 145th. It was time to head downtown and get back on the phone. Mr. Jones was waiting. Time to sell some more stock du jour with a 5% markup.

After a few months I jumped firms to Oppenheimer in Midtown for a big up-front bonus and got an apartment on 62nd and Broadway across from Lincoln Center. My uptown education continued, taking some bizarre twists and turns as we headed into the 1987 crash: October 19, “Black Monday”.

J.J.’s limo rolled up to take him back to NYU. He gave me a lift.

Brand’s Liquor was opening up, “Reliable” restaurant on 145th was already busy serving up plates of collards, Mac ‘n cheese, and fried chicken for $5.

I thought to myself, some people live their whole lives in Harlem and rarely cross 125th Street. They have no idea what happens downtown. But fewer still ever go uptown and experience that whole different universe you find if you trust the unhinged passions in your mind.

Like Denede says, “Buy love, sell fear”.

This article is featured in Bitcoin Magazine’s “The Withdrawal Issue”. Click here to subscribe now.

A PDF pamphlet of this article is available for download.