This is an opinion editorial by Bitcoms, a Bitcoin-focused writer and certified accountant.

With mainstream financial management titans such as

As indicated in the bottom right of the above table, the framework suggests a maximum potential bitcoin capture of $200 trillion, leading to an approximate bitcoin price of $10 million ($200 trillion divided by about 20 million equals about $10 million per BTC.)

In his commentary, Myers suggests that “you can run your own numbers here for the ‘Bitcoin capture’ column and see what you come up with.” So, if we scale everything down by an order of magnitude for our more modest bitcoin capture of $20 trillion (roughly 2.2% of Myers’ $900 trillion “total addressable market”), the same arithmetic gives us an expected price of about $1 million per BTC.

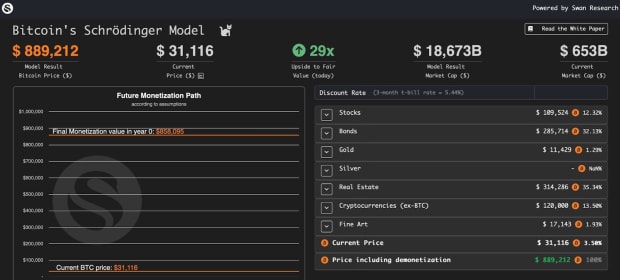

Meanwhile, Alpha Zeta’s model is a sophisticated, interactive tool with a configurable set of input parameters, which (with apologies to its author) I crudely manipulated to approximate the values we used with Myers’ framework. Because the tool allows only for round percentages, I modeled Bitcoin’s asset capture at only 2% (not the roughly 2.2% used with Myers’ model) of $900 trillion. This results in exactly what I would have expected: a similar, but slightly lower, BTC price projection of around $900,000 per coin.

For the sake of dealing with round numbers, let’s say that in capturing about $20 trillion in global investment capital, both tools would suggest an expected bitcoin dollar price of about $1 million. These tools are not only logical, but also consistent with each other. So, what might they miss?

Overlooked Factor One: Lost Bitcoin

Both tools seem to base their price predictions on a reallocated dollar value divided by a rough total number of bitcoin in issue (about 20 million). However, this ignores the fact that some issued bitcoins are unavailable.

First, consider lost coins. The number of bitcoin that have been lost is impossible to quantify with precision, but it has been estimated at nearly 4 million in a 2020 report by Chainalysis. Cane Island Digital’s 2020 report “There Will Never Be More Than 14 Million Bitcoins” suggests a higher number of about 5.4 million lost coins. I sought a third opinion from leading on-chain analyst Checkmate for this article, who kindly shared an initial estimate of “around 3.942 million BTC.”

Using an average of these three data points, we can justifiably posit that, of the 19.4 million bitcoin issued to date, around 4.4 million are lost, leaving 15 million accessible by their owners. This is significantly less than the roughly 20 million typically used in bitcoin pricing models.

Overlooked Factor Two: Hardcore HODLers

Second, consider what proportion of this accessible 15 million bitcoin might never be sold for fiat. The apparent existence of “hardcore HODLers” — true believers who are unwilling to sell at any price — means that the general aphorism that “everyone has their price” may not necessarily apply to Bitcoin.

Potentially-useful research on this overlooked factor is a Glassnode report from 2020, which concluded that “14.5 million BTC can be classified as being illiquid.” This was built upon by Rational Root in his 2023 “HODL Model,” which hypothesizes that by “2024, the illiquid supply… will be… 14.3 million bitcoin.” Subtracting our earlier estimate of 4.4 million lost coins from this total illiquid supply figure (which includes lost bitcoin), these sources suggest that about 10 million of the roughly 15 million accessible bitcoin are in this “illiquid” category, i.e., their HODLers are unwilling to sell.

But quantifying how many of those 10 million illiquid coins will be “hardcore HODL’d” by the diamond handed in the face of unprecedented bitcoin value appreciation is really beyond the limits of analysis and firmly in the realms of conjecture. It seems perfectly rational to me to expect many existing HODLers to part with at least a portion of their stack if the fiat price rises to new all-time highs. Recognizing that any “guesstimate” is more sensible than ignoring this phenomenon altogether, I’m going to suppose just half of those 10 million illiquid bitcoin will be “hardcore HODL’d” as the price goes up.

The Price Effect Of Unavailable Coins

So, once we’ve allowed for 4.4 million lost and 5 million “hardcore HODL’d” bitcoin, that leaves around 10 million coins available for the $20 trillion of captured value in our example scenario. $20 trillion divided by 10 million gives us a $2 million mean price paid per BTC.

That mean of $2 million is double the valuation tools’ unadjusted price estimate of $1 million. So, for me, at this point a reasonable heuristic for gauging the mean bitcoin price is: “everything divided by 10 million” (where “everything” is the total fiat newly allocated to bitcoin, however much that may be).

Overlooked Factor Three: Volatility

But $2 million is the mean price in our example scenario, and the price at any given time during bitcoin’s absorption of the $20 trillion could be significantly higher or lower. So, we also need to predict the range within which the price might move.

Using history as a guide, we see that the dollar-BTC price has become less volatile as bitcoin has grown up from toddler to a teenager, with the ratio of the major USD price tops to subsequent bottoms shrinking as follows:

Presuming that this trend toward lower volatility continues, over the next few years we might plausibly expect a high-to-low ratio of around three. Against our example scenario’s longer-term moving average price of $2 million, that might translate to short-term lows of about $1 million and short-lived highs of about $3 million.

That high of $3 million is triple the valuation tools’ unadjusted price estimate of $1 million. So, for me, a reasonable current heuristic for gauging the maximum price is: “everything divided by 7 million” (where “everything” is the total fiat newly allocated to bitcoin, however much that may be).

Scaling The Example Scenario

Next, we’ll adjust the amount of new capital being reallocated to bitcoin to create alternative scenarios, as follows:

Based on this, for bitcoin’s price to hit $1 million, rather than requiring the roughly $20 trillion reallocation of global investment capital suggested by the raw tools, only around one third of that amount would be needed.

Although modest-sounding in the context of global wealth, such a reallocation would nonetheless involve significant participation by large, slow-moving and conservative pools of capital. In my view, while this is possible over the medium- or long term, this seems improbable within the next few years without seismic disruption in financial markets (such as a major sovereign debt crisis, banking system collapse or persistently vertiginous inflation) accelerating the necessary paradigm shift away from “fiat thinking.”

In the absence of such an event within that time, I see something like the first and most modest scenario in the table as more probable, with temporary highs in the low hundreds of thousands of dollars as “big capital” slowly reallocates to bitcoin.

You may of course have your own opinion on an appropriate heuristic. But, having considered the role of volatility and accounted for unavailable bitcoin (both lost and “hardcore HODL’d”), I think “everything divided by 7 million” is a reasonable gauge for the likely peak price impact of capital redirected to bitcoin. While “everything” here is the total of that capital — which could theoretically be as much as all the stored value in the world — any credible guess at a future price needs to be based on a realistic level of reallocation to bitcoin.

This is a guest post by Bitcoms. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.