June data for the United States and the eurozone show economic contraction underway and that the worst is yet to come. What does it mean for bitcoin?

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Growth Deceleration To Economic Contraction

In today’s issue we present a broad overview of the ever-changing global macroeconomic environment, and finish with its implications for bitcoin.

“The pace of US economic growth has slowed sharply in June, with deteriorating forward-looking indicators setting the scene for an economic contraction in the third quarter.” — Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

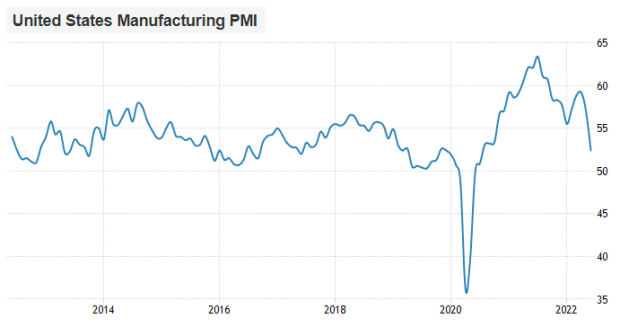

Measured across new sales orders, input costs, employment, work backlogs and business confidence, PMI (Purchasing Managers’ Index) survey data acts as a timely and leading indicator to assess economic health. The latest PMI reading came in this morning at an extremely ugly 52, below expectations of 56. The slowdown in manufacturing can be attributed to sharp rises in the costs of energy and commodities at the same time that rates are increasing at a record pace.

The data shows the first contraction in new orders since July 2020, the steepest pace of new export order contractions since June 2020, slowing inflation in input prices, slowing employment gains and the lowest business confidence since comparable 2012 data. This is not just in the United States either. Households in the U.K. and eurozone are struggling under the weight of inflation as well and we will likely see this continue to show up as a hit to both earnings and growth as the business cycle turns over.

Dollar Short Squeeze

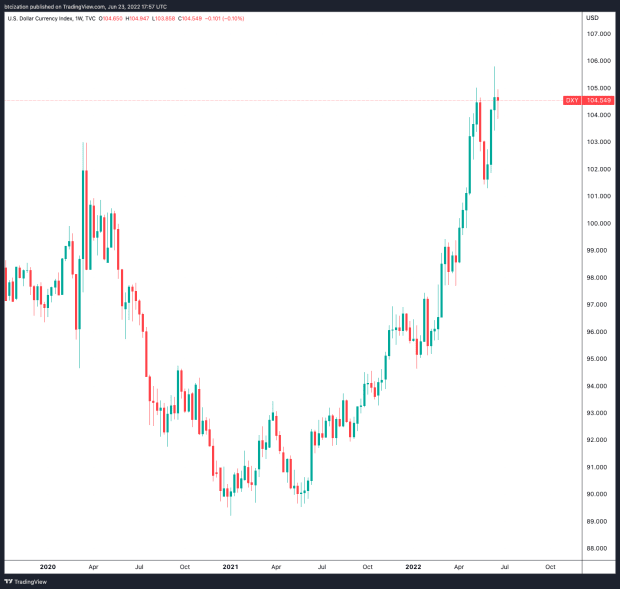

This dynamic, exacerbated by the sheer amount of dollar debt that exists outside the United States’ domestic economy (due to the dollar’s world reserve currency status) is the reason that global economic slowdowns and a strengthening dollar (relative to other currencies) come hand in hand.

This dynamic (a strengthening dollar) is exacerbated by a slowdown in economic activity in the United States, in part due to both the rising price of energy as well as the monetary tightening that is occuring due to the response in inflationary pressures by the Federal Reserve.

A Potential Turning Point

The beginning signs of future rate cuts and a reversal of monetary tightening would be one where we expect bitcoin to once again outperform. This, we expect, will be due to the market’s realization that there is no alternative to perpetual monetary expansion in a fiat currency regime, and that the attributes of an absolutely scarce monetary asset are extremely desirable over the long term. Similarly, we expect the dollar to continue to strengthen relative to financial assets until there is a pivot in policy and a reemergence of monetary easing.

Relation To Bitcoin

As the business cycle turns over, risk assets (obviously including bitcoin) have taken a hit. While equities and bonds are subject to falling valuations due to rising discount rates, bitcoin has no cash flows or dividends, why is it acting similar?

While correlation is by no means causation, a slowing economy and a decrease in growth has shown to correlate nicely with the monetization cycles of bitcoin. While there are plenty of exogenous factors, this relationship, in particular as bitcoin grows in size and liquidity, is one that we don’t believe to be spurious. Increasing business activity and economic growth means more money in consumers’ pockets, meaning greater flows into financial markets, with the nascent bitcoin gaining the most from flows due to its previous (and current) size and liquidity profile.

Final Note

The latest data we’ve highlighted above further illustrates why the worst is yet to come. Some data shows we’re in the beginnings of a global recession today while other data points to a prolonged recession right around the corner.

Although we see bitcoin as a beneficiary of the aftermath, it is not immune to the macro business and growth cycles turning over in front of us, which are far from over. With a market cap at a mere fraction of total global wealth, it moves with broader cycles just like any other asset. This, along with many other reasons we’ve outlined, leads us to believe that the bottom isn’t in yet.