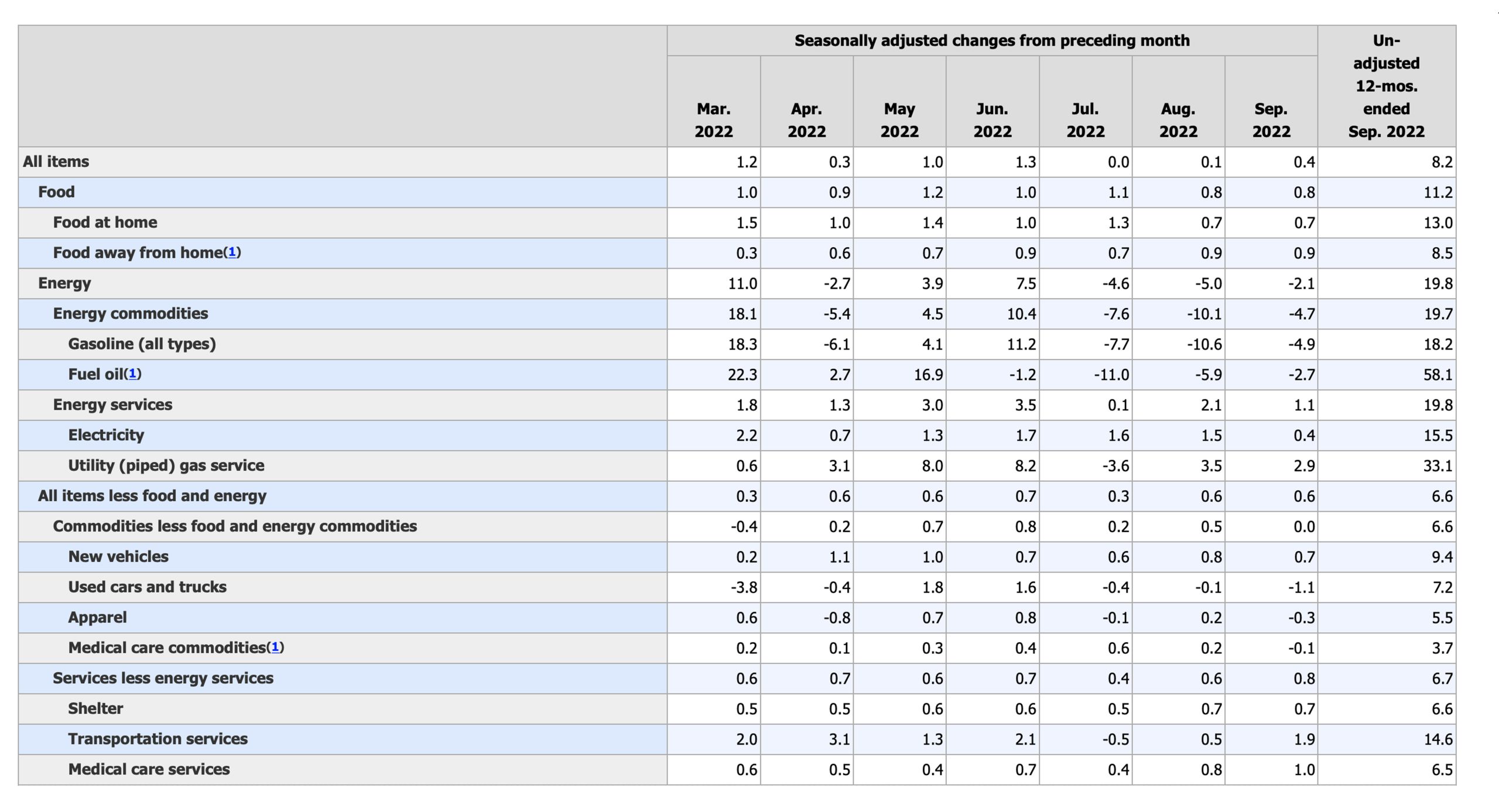

The latest inflation data from the United States indicates that consumer prices have kept climbing despite expectations of a slowdown. The Consumer Price Index (CPI) summary published on Thursday shows an 8.2% rise in the year through September, and the core index rating saw the fastest yearly increase since 1982.

September’s CPI Data Was Worse Than Expected, Report Signals an Aggressive Fed Rate Hike on the Horizon, Global Markets Shudder

U.S. inflation numbers for September are in, and the inflation rate, or CPI, is worse than expected. According to the U.S. Bureau of Labor Statistics’ CPI summary published on October 13, the report shows the “Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis after rising 0.1 percent in August.” The Bureau of Labor Statistics’ report adds:

Over the last 12 months, the all items index increased 8.2 percent before seasonal adjustment.

The latest CPI stats also show that the “index for all items less food and energy rose 0.6 percent in September, as it did in August.” Immediately after the report was published all four major U.S. stock indices dropped significantly against the U.S. dollar with Nasdaq shedding the most losses on Thursday. Crypto markets and precious metals followed the same pattern, led by equity markets by tumbling in value against the greenback after the CPI report was published.

US #inflation hotter than expected. September CPI rose 8.2% YoY vs 8.1% expected. Core CPI accelerated to 6.6% YoY, highest since 1982. pic.twitter.com/WLTqzd6o1M

— Holger Zschaepitz (@Schuldensuehner) October 13, 2022

Precious metals like gold and silver also took a hit on Thursday as gold is down 1.37% per troy ounce and silver is down 1.68%. Platinum and palladium have also seen losses between 1.59% and 2.91%. Metrics on Thursday further show that the crypto economy has dealt with heavy losses as well, as the entire market capitalization of all the digital assets in existence has slid under the $900 billion mark.

At the time of writing, the global crypto market cap is roughly $886.38 billion, down close to 4% during the last 24 hours. Of course, the worse-than-expected inflation data from the Bureau of Labor Statistics’ CPI report is making investors believe an aggressive Federal Reserve will hike the federal funds rate by another 75 basis points (bps). According to the Investing.com Twitter account, the “Fed funds futures [is] now pricing [in a] 100% chance of 75 bps Fed rate hike at [the November] meeting following CPI data.”

What do you think about the latest inflation report stemming from the U.S. Bureau of Labor Statistics and the market reaction after it was published? Let us know what you think about this subject in the comments section below.