Bitcoin trading above the 50-day simple moving average is a bullish indicator for the bitcoin price and many long-term holders are taking note.

This is an opinion editorial by Mike Ermolaev, head of public relations at the ChangeNOW exchange.

As a retail trader or someone who just got started with bitcoin not long ago, you may be searching for clues about what to expect next with its price. A second opinion is also important for seasoned bitcoin investors to compare their own perspectives.

Analyzing Open Interest Of Bitcoin Futures

Bitcoin open interest provides insight into how much money is flowing into and out of the bitcoin derivatives market. Derivatives like bitcoin futures and perpetual swaps are used by traders to speculate on whether bitcoin’s price will rise or fall without having to own the digital asset. A higher bitcoin open interest means more traders have opened positions, while a lower one means more traders have closed them.

As of writing, bitcoin-denominated open interest had increased to 592,000 BTC from 350,000 BTC at the start of April 2022. A look at the bitcoin denomination can help isolate periods of increased leverage from price fluctuations.

In USD terms, current open interest is $13.67 billion, which is relatively low, comparable to early bull market levels in January 2021 and June 2021 sell-off lows.

Whenever there is a large increase in open interest on a BTC basis, but not on a USD basis, that signals markets are taking on more BTC exposure, but still don’t expect it to move much.

Funding Rates Rise For Perpetual Swaps

In order to understand how most traders are positioned in the market, we can look at funding rates used on perpetual swap contracts: derivative financial contracts unique to bitcoin and cryptocurrency that have no expiration date or settlement. They allow traders to use leverage — up to 100x — when betting on the price of bitcoin. A funding rate is a periodic payment made to or by a trader who is long or short based on the difference between the perpetual contract price and the spot price.

Generally, we can say that positive funding rates indicate traders are taking long positions and are generally bullish about the price moving upward, whereas negative funding rates indicate traders are usually taking short positions and are generally bearish, believing the price will move downward. Funding rates breaking above 0.005% signal increased speculative premium, a trend that is currently occurring.

The Bitcoin Price Is Above Its 50-Day Simple Moving Average

Analysts like myself who use technical analysis charts and patterns to make investment decisions, note that bitcoin is currently trading above its 50-day simple moving average (SMA) — an effective trend indicator — for the first time since mid-July. This confirms that underlying momentum may be building.

Long-Term Holders See Bitcoin As An Appealing Risk/Reward Investment

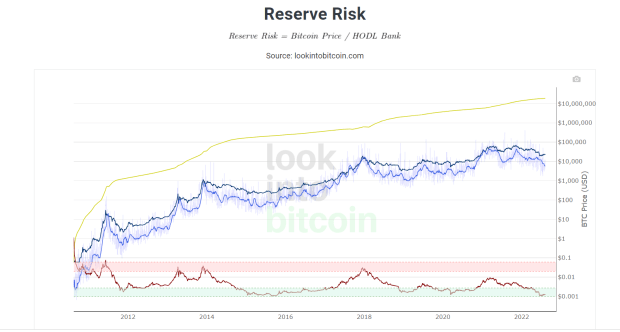

Below is another chart that visualizes how long-term BTC holders feel about bitcoin relative to its price. Bitcoin’s long-term holders are generally better at identifying the best time to buy and sell bitcoin. This is not surprising, since they have more experience in the field than newcomers who are just getting started. It is important to recognize when they are confident that the number one cryptocurrency will rise in price in the future.

The reserve risk chart is currently in the green zone, meaning a high level of confidence combined with a low price, making bitcoin an attractive risk/reward investment. Investors who invest during green reserve risk have historically enjoyed high returns over time.

Conclusion

Market perceptions of various savvy market participants, who have traditionally been smart in making their investment decisions, show that they are increasingly confident about the future of bitcoin price and are willing to take on more price risk. There is a cautious upward bias in bitcoin derivatives markets and long-term investors appear to be fairly confident. The bitcoin price is also showing signs of improvement based on technical indicators.

Disclaimer: This is not financial advice. All opinions, statements, estimates, and projections expressed in this article are solely those of Mike Ermolaev, PR Head at ChangeNOW.

This is a guest post by Mike Ermolaev. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.