“What underpins a world order is always the financial system.

We are on the brink of a dramatic change where we are about to, and I’ll say this boldly, abandon the traditional system of money and accounting and introduce a new one. And the new one is what we call blockchain.

It means digital. It means having an almost perfect record of every single transaction that happens in the economy, which will give us far greater clarity over what’s going on. It also raises huge dangers in terms of the balance of power between states and citizens. In my opinion, we’re going to need a digital constitution of human rights if we’re going to have digital money.

Most people think that digital money is crypto and private, but what I see are superpowers introducing digital currency. The Chinese were the first. The US is on the brink of moving in the same direction. The Europeans have committed to that as well.”

This revolutionary speech about a new financial system, was delivered at the World Government Summit in March 2022 in Dubai, by Philippa “Pippa” Malmgren, a member of the Council on Foreign Relations (CFR) and Chatham House; her father, Harald Malmgren served as a senior advisor to US Presidents Kennedy, Nixon, Ford and others. She’s a technology entrepreneur and economist, who served as Special Assistant to President George W. Bush, for Economic Policy on the National Economic Council and is a former member of the President’s Working Group on Financial Markets and Corporate Governance.

Her words about the transition to a new world order that requires a new financial structure correspond well with the words of French President Emmanuel Macron in June 2023 at the Global Finance Summit in Paris: “The world needs a public financial shock to fight global warming, and the current system is not suitable for dealing with the world’s challenges.” The president of Brazil, Lula da Silva, also called for “a clean slate” and said the Bretton Woods organizations (World Bank, International Monetary Fund) do not serve their goals nor respond to society’s needs.

“The New Bretton Woods Moment”

“A new international monetary system is taking shape, some call it the new Bretton Woods moment that needs to be seized to create a new global financial governance,” says the investigative journalist Whitney Webb in a recent sitdown interview, where she mention that according to Mark Carney, former governor of the Bank of England & Bank of Canada and the UN Special Envoy for Climate Action and Finance, the three pillars of the new multi-polar world are Digital IDs, CBDCs and ESG, through a global carbon market. All world governments are pushing this agenda, that in order for it to succeed, all monetary systems and supporting systems must become digital and rely on digital data.

A good example of this was revealed at an event of the Central Bank of Israel with the Bank for International Settlements (BIS) – which I attended – in September 2023 in Tel Aviv, where the “Genesis Project” was presented. As part of this project, “green” bonds are issued, based on carbon quotas in the CBDC infrastructure. This is how the climate agenda is linked to financial markets.

“Debt Serfdom”

“Stablecoins could be the way in which the US is further globalizing the dollar, spreading its adoption directly to the world’s general public in order to continue increasing its debt and encourage uptake and usage of the dollar”, says Mark Goodwin, Editor in Chief of Bitcoin Magazine, in this interview with Whitney Webb. He suggests that the politician’s outcry of de-dollarization and the weakening of the dollar are a distraction from perpetuating the dollar as the world’s reserve currency.

“While CBDCs are what people are becoming fearful and aware of, it may just be the red herring, and the real strategy of the US dollar’s survival is highly regulated stablecoins (such as Tether), which can easily be programmable, even more than CBDCs, as well as seized, regulated and controlled indirectly by governments. 100 billion dollars in treasuries were already purchased by Tether, its subsidiaries and owners. Tether is positioned alongside the top 20 nation states buying debt from the US, with around one tenth of China or Japan that have a trillion dollars debt to the US”.

This theory, together with the words of Mark Carney, Pippa Malmgren, Emmanuel Macron & Lula Da Silva, join the calls of global leaders and heads of states, pointing to the replacement of the monetary and financial world order, to introduce a new monetary system. Many experts say that we are reaching the end of the current fiat monetary system experiment, which is destined to collapse. Since world leaders are aware of this, they prefer to engineer a controlled demolition, to maintain control and steer the course, and enter the new era with power firmly within their grasp.

Central Bank Digital Currency System (CBDC)

Central Bank Digital Currencies (CBDC), tie the financial freedom of citizens to the government and the banking establishment. The central bank issues its centralized digital currencies, and essentially creates a new monetary system, “fiat on steroids”, a system that takes everything that is bad in the fiat system, and adds more of it; surveillance, control, censorship, and enforcement capabilities. A modern prison? Indeed, the CBDC is the ultimate prototype of a prison without physical chains. By connecting CBDCs to digital identity cards, and to government systems such as universal basic income, social credits and more, we get the ultimate control apparatus. This apparatus will dictate to citizens what they’re allowed to purchase, what the permitted quotas are while limiting consumption according to rules and use cases, at programmed times, places and cadences. The system is able to determine the use of a geographic radius (geo-fencing), and to determine expiration dates on the money. Each remote controlled digital wallet can also be switched on and off by its operators. More than 130 countries are in the initial stages of piloting CBDC systems, of which 36 countries are in advanced pilots, and 3 countries have already launched systems (Nigeria, Jamaica and the Bahamas).

Will Ripple (XRP) Be The Chosen Platform for CBDC?

Ripple, a digital payment network and transaction protocol that owns the cryptocurrency XRP, is considered one of the most popular cryptocurrencies, and is strategically positioning itself at the heart of government financial innovation, aiming to be the cornerstone of future CBDCs.

The company is in talks with about twenty governments around the world to develop their CBDCs using Ripple’s technology. In May 2023, Ripple launched a dedicated CBDC platform to assist central banks, governments and financial institutions around the world in issuing CBDCs and stablecoins. To date, Ripple has partnered with six governments for CBDC pilot projects: Georgia, Colombia, Montenegro, Hong Kong, Bhutan and the Republic of Palau.

The National Bank of Georgia, for example, has chosen Ripple as its technology partner for its CBDC pilot last year, citing Ripple’s technical expertise and team capabilities. Its interest in CBDCs is in leveraging modern technologies, such as the programmability aspect of CBDCs, aiming to create a platform with smart contract and programmable token capabilities to stimulate innovation in the financial sector.

In the case of Bhutan, Ripple’s technology was chosen in 2021 for the country’s CBDC project to enable advanced cross-border payments, and assist in “financial inclusion” – in line with Bhutan’s mission to increase financial inclusion in Bhutan to 85% by 2023.

In 2022, Ripple reached the final stage of the G20 Techsprint CBDC Hackathon, hosted by Indonesia and the Bank of International Settlements (BIS), and in August 2023, the Republic of Palau launched a USD-backed digital currency, developed by Ripple.

Promoting its platform as an infrastructure for a CBDC, Ripple advocates for government regulation of cryptocurrencies, and tries to position itself as the preferred solution for CBDC projects. Its claim to fame of being the ideal CBDC partner for governments is the combination of speed, efficiency, a sustainable and “green” blockchain network that uses little energy (compared to the Bitcoin network), and interoperability – the ability to communicate and work with CBDC solutions in other countries on the Ripple infrastructure. The company warns that there is a risk for CBDC adoption by the public, caused mainly by a lack of market education, and it encourages the programming and expiration dates capabilities, which are perceived by most of the public as particularly Orwellian features of CBDCs.

Ripple encourages the abolition of cash (and a move to a cashless society), and unsurprisingly, it promotes the climate agenda; The company’s website presents its commitment to a clean, prosperous and secure low-carbon future, with a plan to reach carbon net-zero by 2030.

Apparently, in line with Ripple’s expansion strategy vis-a-vis governments, the company makes sure to recruit employees who came from central and commercial banks. One of the company’s top executives is Andrew Whitworth, policy director at Ripple, who previously worked at the Bank of England. At the same time as his role in Ripple, Whitworth also serves as a Director of the “Digital Pound Foundation”, an organization that has declared itself the authority on the Digital Pound; it advises and influences the government’s decisions regarding CBDC projects and deployments. Clearly an inside connection such as this might give Ripple an advantage in shaping digital currency policies to fit their platform and solutions. Does this hint a conflict of interests, or at least an unfair play?

Another avenue through which institutional influence and implicit control over Ripple could manifest is via a legal battle with the SEC (U.S. Securities and Exchange Commission) concerning the XRP cryptocurrency. Engaging in such legal disputes inevitably positions Ripple in a scenario where maintaining a positive relationship with institutions becomes crucial. Consequently, it’s no surprise that Ripple prioritizes governments, central banks, and financial institutions as its primary target audience in its market strategy.

Interesting Developments in CBDC

China spent a couple of years rolling out relatively failed CBDC projects without widespread adoption, while injecting 30 million yuan as free money to encourage user adoption. Transactions using the digital yuan hit 1.8 trillion yuan (US$249 billion) in June 2023.

Recently, significant progress has been made: the two main payment services and applications in China – WeChat and Alipay – which have a traffic of about 3-4 trillion dollars per year, integrated the Chinese CBDC service into their applications. The central bank regulator made it clear that digital yuan isn’t meant to compete with the two payments giants. Rather, it’s supposed to play a complementary role.

Elon Musk, who owns, among other things, the Twitter/X platform, has stated that he wants to make the platform an “everything app” like the Chinese WeChat, including payment management. Will X also follow the Chinese route and integrate the CBDC solution into it, or will it try to become a CBDC infrastructure itself with the help of Musk’s favorite cryptocurrency, the Dogecoin?

The CBDC pilot in Nigeria didn’t exactly take off either, after the citizens took to the streets to protest the abolition of cash in the country, and resented the introduction of an unneeded digital solution, while demanding the return of cash. After a long and painful protest, the cash was returned alongside the new digital currency, which was not canceled and became part of reality. Furthermore, a new stablecoin is in preparation in Sandbox mode in Nigeria. The cNGN is a Naira stablecoin which some claim has more potential than the e-Naira to be widely adopted. “The stablecoin will be more broadly interoperable than the CBDC, which is only available in the central bank’s wallet. At launch, the central bank’s wallet usability was weak, although it is now quite good”, said Bolu Abiodun, a reporter at Techpoint Africa.

The UK saw a strong public backlash to Prime Minister Rishi Sunak last year, with more than 50,000 responses sent to the Bank of England following a public hearing on the Digital Pound, aka the UK’s national CBDC.

Germany – Awareness of “Excessive Surveillance”

In Germany, the technical guidelines document for a digital currency of a central bank was published in January 2024. Below are several quotes from the document, reflecting the tyrannical nature of the new currency, and the awareness of the central bank for trust issues it can create:

- Programmability is the institution’s authority to dedicate your money for certain uses, and to prohibit the use of your wallet when it is “outside the permitted scope”.

- “The central bank can revoke CBDC notes, e. g. as an instrument of monetary control. Revocation of CBDC notes is performed by an authorized entity, the revocation authority, controlled and operated by the central bank.” This sounds like a technique to confiscate and apply a shelf life to money.

- “Payments permitted under certain restrictions.. if the central bank sees fit to impose them” – the document lists restrictions that can be applied to wallets, depending on the amount of personal information that will be provided. For example, the amount of money in the wallet, the number of payments per day, the amount of money per transaction or per day.

- The good news: The German central bank is aware of the possibility of public opposition to a surveillance system: “Many of these design choices are general decisions on the trade-off between excessive surveillance and legitimate monitoring functions for AML and KYC purposes in conjunction with measures for mitigating fraud and misconduct. These decisions are extremely sensitive in nature and can strongly influence the level of trust that users place into the CBDC”.

Israel – The Digital Shekel Will Be Distributed Through Commercial Banks

Israel takes an extensive and active part in various CBDC pilots, such as the Sela project, Eden, Icebreaker and more, which I have reported on extensively in the past. The Deputy Governor of the Bank of Israel announced that in December 2024 a technical design document for the Digital Shekel will be published, and its implementation will then begin in partnership with the private sector.

The Bank of Israel’s latest document from last week covers the proposed architecture of the Digital Shekel. Here are some interesting points from the document:

- The distribution of the Digital Shekel will be two-tiered: instead of direct contact between consumers and the central bank for funding and defunding, an indirect method similar to the distribution of cash today will be used. The banks will purchase digital shekels from the central bank in large quantities and transfer them to customers upon wallet charging.

- The system will be able to apply and enforce limits, for example limits on the balance that users are allowed to hold in the Digital Shekel.

- The system will support the possibility of applying interest on the Digital Shekel.

- Users will be able to access the Digital Shekel through several payment providers, including credit cards, Google/Apple Pay, wearables, payment apps and more.

- Unlike most retail CBDC solutions, Israel’s model allows users to open a wallet with a payment service provider (PSP) and connect to multiple third-party banks to fund and defund balances.

Another interesting development in Israel is the announcement of a plan to launch a new stablecoin pegged to the shekel, called BILS, by the exchange platform, Bits Of Gold. Crypto Jungle website reports that the Israeli Capital Market Authority approved the pilot, according to the draft principles published by the Central Bank of Israel. Interesting to note that the company providing the infrastructure for the issuance and custody of the currency is the Israeli technology giant “FireBlocks”, which took part in the “Eden” pilot project of the Tel Aviv Stock Exchange for the issuance of digital bonds, built to adapt in the future to a potential CBDC infrastructure.

No Internet? Don’t Worry, Governments Will Take Care Of Connectivity Anyway

A number of CBDC pilots, like in India, the European Union and more, focus on the adoption of the system by everyone, even amongst people without internet access. The washed-up name “financial inclusion” implies that the system will not skip anyone, not even citizens without Internet connectivity in remote areas, or without reception. In India for example, there are 683 million people living without an internet connection and largely outside the control of the state. The Reserve Bank of India (RBI) plans to bring these remote areas into a new surveillance network through various technological means. A successful launch of CBDC in India also corresponds with the government’s overarching goal of reducing cash usage and improving financial monitoring.

Thailand – Free Money for the Masses

In September 2023, the Thai government announced that any Thai citizen over the age of 16 who chooses to participate in the CBDC pilot, will receive free CBDC worth $280 (10,000 baht) – quite a lot of money in Thai terms. This digital money will be loaded into the digital wallet application and will be available for use within 6 months, and within a radius of 4 km from the residence of the registered citizens. The pilot targets low-income citizens as a first stage, and later expands to entrepreneurs and small business operators – provided they are registered in the tax system. In Thailand many citizens are not registered in the government systems and not everyone has a bank account. It seems that air-dropping “free money” is another tactic to lure citizens into government systems, with the bait of “free” controlled government money. But is there such a thing as “free lunch”?

The European Union – a Positive Marketing Campaign in High Gear

The European Union launched a marketing campaign to promote the digital euro about six months ago, to start educating the European public about a reality where that they will be obliged to use a supervised digital euro, led by Christine Lagarde, who was previously convicted of crimes and was promoted to serve as the governor of the European Central Bank, the ECB.

The Digital Euro new marketing campaign. Source: Christine Lagarde’s Twitter account

At the same time, a charade is going on in the European Union Parliament where the dangers of CBDCs are being discussed, only thanks to the public awareness and discourse, while Lagarde rushes forward and kicks off the marketing campaign to instill in the public the following messages: the digital euro is easy, safe, fast and reliable. Not a word about its Orwellian capabilities to track, program, limit and condition activity through expiration dates, geo-fencing, and remote on and off switching.

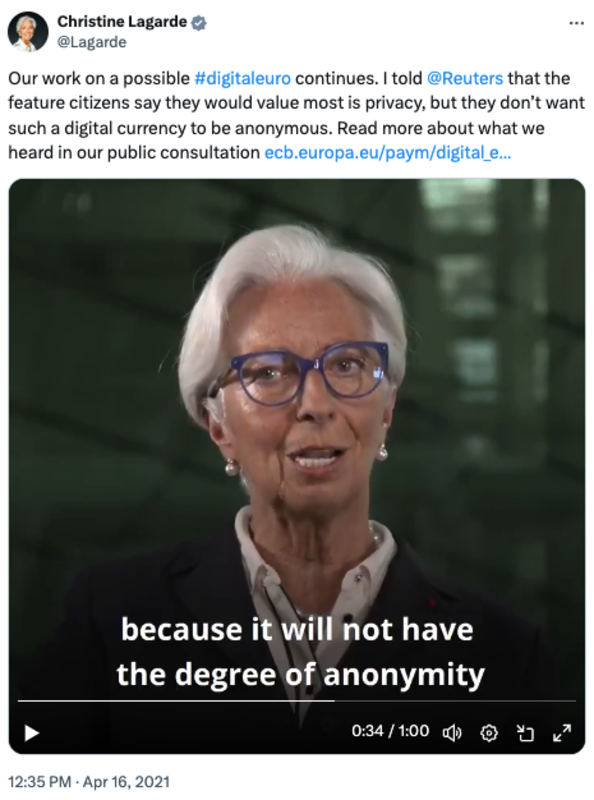

The Digital Euro Will Not Be Anonymous

In a discussion at the European Union Council in 2023, Lagarde emphasizes a point: the digital euro will not be anonymous. Privacy will exist in the system, but not anonymity. Let’s break this up in a different way: for the banks, the key to surveillance and control is identification. The bank must know who the citizen is and verify their identity, in order to exercise law enforcement or regulations, through technological restrictions. Lagarde’s claim that the technology will allow privacy but not anonymity is unfounded: apparently the central bank considers itself and the financial service providers some kind of God, since in front of them the citizen will be identified, and therefore it is not clear what kind of privacy can exist, without anonymity.

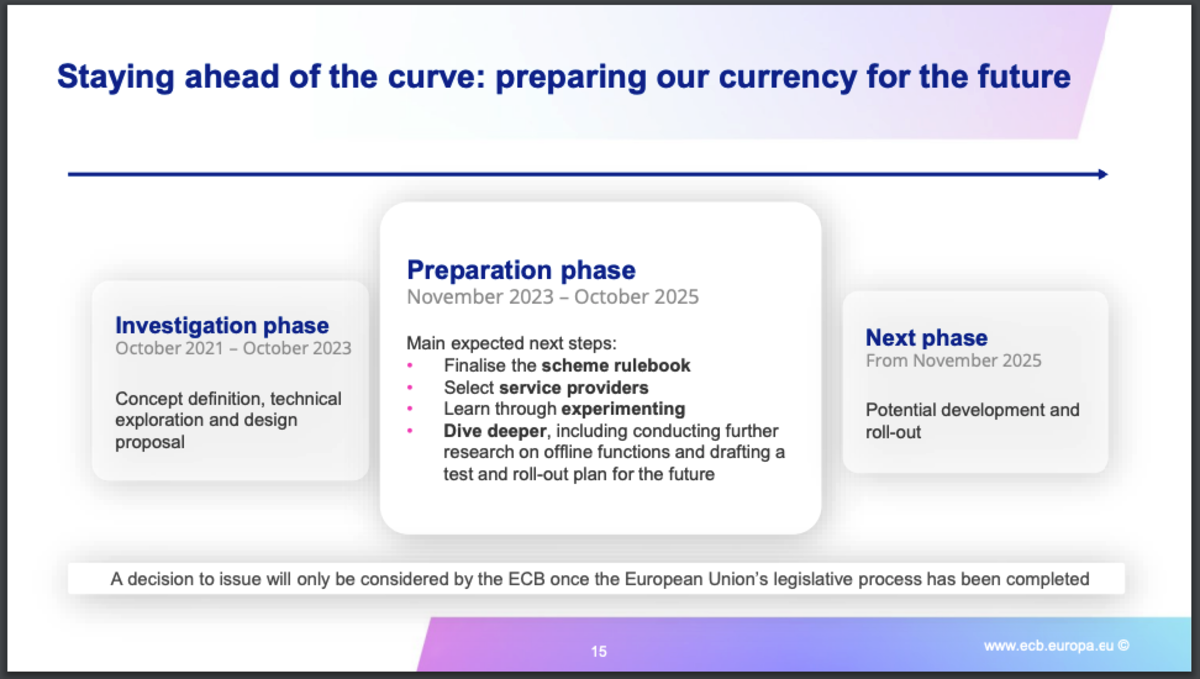

In a presentation from March 2024, the ECB presents a timetable for the Digital Euro. In November 2025, the development and implementation phase will begin, with the completion of the “democratic” legislative process.

The timing of the launch of the Digital Euro corresponds well with the European Union’s initiative to issue digital identity cards to all EU residents between now and 2030, to enable the necessary government identification and tracking of its citizens. Identical initiatives are enacted and promoted in many other countries around the world at the same time. Where I live, in Israel, ID cards and passports have been mandatory and digital for many years, and also biometric since 2013 – therefore there is no need to start the marketing campaign for the Digital Shekel yet, as the digital infrastructure exists hence the first step of digitalization is already done.

This phase of the project is the “preparation phase”, the ECB reveals, in which they are preparing for the launch phase of the Digital Euro. Of course, we are reassured that no final decision has yet been made regarding the launch of the CBDC, and this will only happen with the approval of the “Government Council” after the completion of the democratic legislative process of the European Union. Therefore, in parallel with the democratic debate for or against the Digital Euro, the development of the technology will continue, in order to be prepared for the launch.

Central bank governors such as Lagarde and Bank of Israel Governor Amir Yaron insist that the CBDC is digital cash, and also insist that physical cash will not be abolished. It is possible that these central bankers feel the need to make a U-turn from the incriminating speech of the head of the Bank for International Settlements (BIS), Augustin Carstens, who caused a public outcry when he stated in 2020 that the CBDC technology, unlike cash, will allow monitoring of financial transactions and will be a means of enforcement by the establishment:

“The key difference with the CBDC is the central bank will have absolute control of the rules and regulations that will determine the use of that

expression (money) of central bank liability, and also we will have the technology to enforce that.”

Agustín Carstens – BIS General Manager

The Future: Centralized and Controlled, or Free, Decentralized and Secure?

Ayn Rand, author and philosopher, said that “We can ignore reality, but we cannot ignore the consequences of ignoring reality.” Are we taking giant steps towards a new monetary reality, where the fiat currencies we know become fiat on steroids, aka CBDCs? Or into the reality of “stable” and closely regulated cryptocurrencies, tethered to fiat? Either way, the feeling is that the establishment is doing everything to preserve the debt economy, and its inherent modern slavery. The only way to break these fiat-matrix boundaries is to opt out and enter into a new system, which seems to run in a parallel reality, the Bitcoin system. On the Bitcoin standard, under self-custody, no third party has the ability to confiscate, program or take over private assets. Not even the government or the state. Bitcoin uses a lot of energy for its mining, but this proof-of-work mechanism makes the blockchain network extremely secure and the Bitcoin currency very valuable. Bitcoin is “safe money”, which is out of reach for the establishment. Unlike most other cryptocurrencies, Bitcoin is a digital currency without intermediaries or third parties (peer-to-peer) in a decentralized and secure network, which allows everyone to be their own bank, instead of relying on banks and external parties. With a fixed and known supply, it represents the most powerful digital asset on the market as a store of value and as a unit of account, and in the future will also be used as a medium of exchange.

In my recent interview with the media and finance expert, and one of the most famous Bitcoiners, Max Keiser, he compared the CBDC to a parasitic and centralized cancer: “If you were to look at the amount of energy that Bitcoin uses and the rate at which it’s increasing, you would say good is triumphing over evil. So this gives me a lot of hope. And I don’t think centralization in anything works at all, except cancer. Cancer is the only thing that seems to work to be overly centralized and parasitic. That’s the cancer model, but I think we’re gonna win against the cancer of CBDCs.”

Follow Efrat’s work here.

This is a guest post by Efrat Fenigson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.