Let’s imagine a nuclear power plant that integrates bitcoin mining on site. How does its profitability compare to a standard operation’s?

Welcome to part two of this series on Bitcoin and nuclear energy. Let us recap what we went through

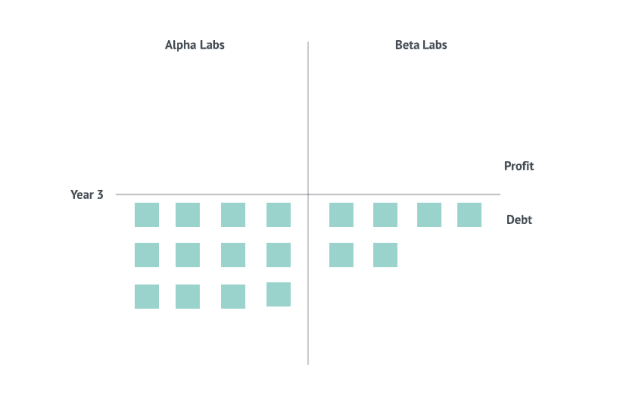

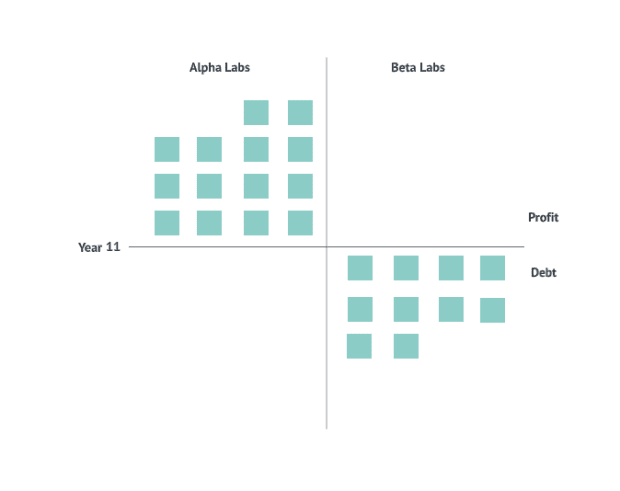

Now, we’ll use blocks of capital to represent the economics of both Alpha Labs and Beta Labs over the next many years so as to compare what their debts and profits would look like.

Let us assume about $57 million is one block. We’ll represent this as a green block on the graph going forward.

So, it’s mid-2016 and both NPP constructions are about to begin.

Year One: 2016

Beta Labs: Takes out its first $1 billion in capital to begin construction. Based on this, it would need to pay one block of debt, which is added to its balance sheet below.

Total capital drawn: $1 billion

Total debt: One block

Alpha Labs: Takes out its first $2 billion in capital to begin construction. Based on this, it would need to pay two blocks of debt, which is added to its balance sheet below.

Total capital drawn: $2 billion

Total debt: Two blocks

Year Two: 2017

Beta Labs: Takes out another $1 billion in capital. Based on this, it would need to pay two additional blocks of debt in year two, which is added to its balance sheet below.

Total capital drawn: $2 billion

Total debt: Three blocks

Alpha Labs: Takes out another $2 billion in capital. Based on this, it would need to pay four additional blocks of debt in year two which is added to its balance sheet below.

Total capital drawn: $ 4 billion

Total debt: Six blocks

Year Three: 2018

Beta Labs: Takes out another $1 billion in capital. Based on this, it would need to pay three additional blocks of debt in year three, which is added to its balance sheet below.

Total capital drawn: $3 billion

Total debt: Six blocks

Alpha Labs: Takes out another $2 billion in capital. Based on this, it would need to pay six additional blocks of debt in year three which is added to its balance sheet below.

Total capital drawn: $6 billion

Total debt: 12 blocks

Year Four: 2019

Beta Labs: Takes out another $1 billion in capital. Based on this they would need to pay four additional blocks of debt in year four, which is added to its balance sheet below.

Total capital drawn: $4 billion

Total debt: 10 blocks

Alpha Labs: Takes out another $2 billion in capital. Based on this, it would need to pay eight additional blocks of debt in year four which is added to their balance sheet below.

Total capital drawn: $8 billion

Total debt: 20 blocks

Year Five: 2020

Beta Labs: Takes out another $1 billion in capital. Based on this, it would need to pay five additional blocks of debt in year five which is added to their balance sheet below.

Total capital drawn: $5 billion

Total debt: 15 blocks

Alpha Labs: Takes out another $2 billion in capital. Based on this, it would need to pay 10 additional blocks of debt in year five which is added to its balance sheet below.

Total capital drawn: $10 billion

Total debt: 30 blocks

Year Six: 2021

Beta Labs: No additional capital. So, it would need to continue paying five additional blocks of debt in year six which is added to its balance sheet below.

Total capital drawn: $5 billion

Total debt: 20 blocks

Alpha Labs: No additional capital. So, it would need to continue paying 10 additional blocks of debt in year six which is added to its balance sheet below.

Total capital drawn: $10 billion

Total debt: 40 blocks

Year Seven: 2022

This is where things get interesting now. Both Alpha Labs and Beta Labs have completed their NPP constructions and are now ready to produce electricity. At this point, both companies’ balance sheets have nothing but a massive compilation of debt obligations based on the amount of capital they have taken out for their respective constructions.

Assumptions

- Let us assume that the all in revenue from selling 1 GWe electricity per year in the wholesale power markets is about $525 million with a clearing price of 6 cents per kWh. This means, based on our block model, that both Alpha Labs and Beta Labs would make about nine blocks of revenue each year going forward from selling electricity. We would assume that both companies will run their NPPs at full power or capacity factor of 100%.

- Let us assume that the operating cost of running the NPP per year is about $100 million per GWe. This includes the yearly fuel cost and variable operations and maintenance. This means, based on our block model, that both Beta Labs would spend about blocks in covering operating expenses every year going forward while Alpha Labs would spend about four blocks in covering operating expenses every year going forward.

Assumptions And Estimates For Bitcoin Mining

- Mining numbers and profitability analysis was done on June 18, 2022 for this article, when the bitcoin price was about $20,000, network difficulty was 30 T and the network hash rate (30 days) was 215 exahashes per second (EH/s). The mining revenue projections take into account the halving in 2024 and take an assumption that both bitcoin price and difficulty would increase 50% on average every year for the next five years.

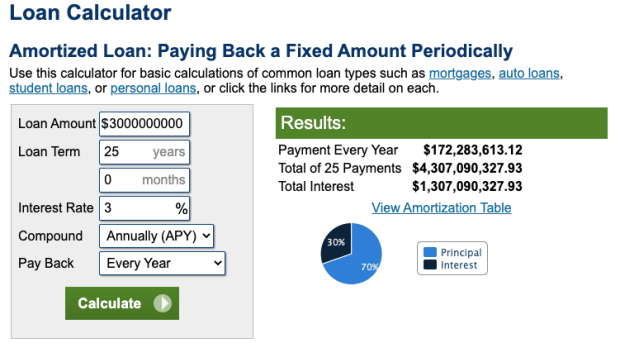

- Let us assume that Alpha Labs is able to secure latest-generation ASIC miners at the cost of about $10,000 each for their 1GWe mining colocation center. Based on the average power draw from a single miner, Alpha Labs would need around 300,000 miners. The total capital cost for this side of the operation would be about $3 billion which it would draw from its existing capital line at the same terms as before. This means that they would need to pay an additional debt of about $172 million (or the equivalent of three blocks) every year going forward for this new capital draw.

- Let us assume that the mining hardware would have a life of five years.

- Let us assume that Alpha Labs keeps no bitcoin on its balance sheet from this exercise and therefore converts all mining revenue into USD.

- Let us run some mining profitability numbers using Braiins OS to get a projection of how much revenue Alpha Labs would make over the next five years of mining with this mining equipment:

- Here are the mining revenue results that Alpha Labs would make each year:

- Year seven: $1.5 billion or about 27 blocks

- Year eight: $1.6 billion or about 29 blocks

- Year nine: $970 mil or about 17 blocks

- Year 10: $1.1 billion or about 19 blocks

- Year 11: $1.25 billion or about 22 blocks

Now, let us continue with our block analysis of both companies’ balance sheet.

Beta Labs: 20 blocks in debt already, five additional blocks in debt for year seven, two blocks in operating expenses, nine blocks in 1GWe to grid revenue

Yearly profit and loss = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 20 blocks – 2 blocks = 18 blocks

Alpha Labs: 40 blocks in debt already, 10 additional blocks in existing debt for year seven, three additional blocks in miner debt taken for year seven, four blocks in operating expenses, nine blocks in 1 GWe to grid revenue, 27 blocks in 1 GWe mining revenue

Yearly profit and loss = (9 blocks + 27 blocks) – (10 blocks + 3 blocks + 4 blocks) = 19 blocks

Total debt = 40 blocks – 19 blocks = 21 blocks

As you can now see, Alpha Labs is moving up from the trenches of debt collection much quicker than Beta Labs, which would take a long time to turn profitable.

Year Eight: 2023

Beta Labs: 18 blocks in debt already, five additional blocks in debt for year eight, two blocks in operating expenses, nine blocks in 1 GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 18 blocks – 2 blocks = 16 blocks

Alpha Labs: 21 blocks in debt already, 10 additional blocks in existing debt for year eight, three additional blocks in miner debt taken for year eight, four blocks in operating expenses, nine blocks in 1 GWe to grid revenue, 29 blocks in 1 GWe mining revenue

Yearly profits and losses = (9 blocks + 29 blocks) – (10 blocks + 3 blocks + 4 blocks) = 21 blocks

Total debt = 21 blocks – 21 blocks = 0 blocks

Alpha Labs has broken even in year eight in just its second year of NPP operation while Beta Labs still has 16 blocks in debt remaining on their balance sheet. The difference on the balance sheets between the companies has suddenly become astonishingly wide. Alpha Labs has been able to wipe off 40 blocks of debt over just two years of operation.

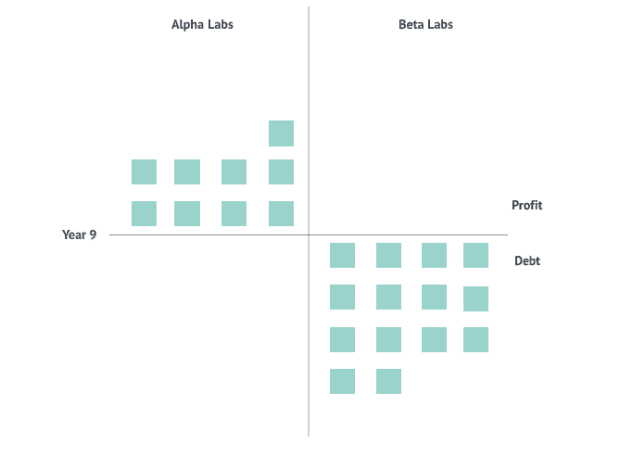

Year Nine: 2024

Beta Labs: 16 blocks in debt already, five additional blocks in debt for year nine, two blocks in operating expenses, nine blocks in 1GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 16 blocks – 2 blocks = 14 blocks

Alpha Labs: Zero blocks in debt already, 10 additional blocks in existing debt for year nine, three additional blocks in miner debt taken for year nine, four blocks in operating expenses, nine blocks in 1 GWe to grid revenue, 17 blocks in 1 GWe mining revenue

Yearly profits and losses = (9 blocks + 17 blocks) – (10 blocks + 3 blocks + 4 blocks) = 9 blocks

Total Profit = 9 blocks – 0 blocks = 9 blocks

Year 10: 2025

Beta Labs: 14 blocks in debt already, five additional blocks in debt for year 10, two blocks in operating expenses, nine blocks in 1 GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 14 blocks – 2 blocks = 12 blocks

Alpha Labs: Nine blocks in profit already, 10 additional blocks in existing debt for year 10, three additional blocks in miner debt taken for year 10, four blocks in operating expenses, nine blocks in 1 GWe to grid revenue, 19 blocks in 1 GWe mining revenue

Yearly profits and losses = (9 blocks + 19 blocks) – (10 blocks + 3 blocks + 4 blocks) = 11 blocks

Total Profit = 9 blocks + 11 blocks = 20 blocks

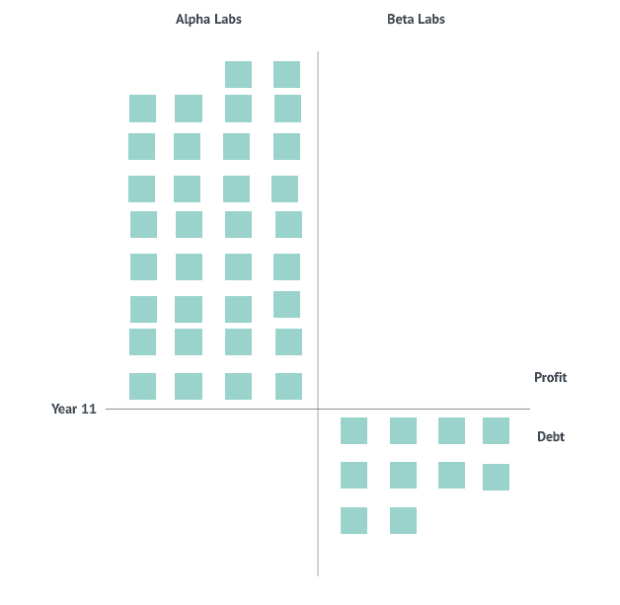

Year 11: 2026

Beta Labs: 12 blocks in debt already, five additional blocks in debt for year 11, two blocks in operating expenses, nine blocks in 1 GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 12 blocks – 2 blocks = 10 blocks

Alpha Labs: 20 blocks in profit already, 10 additional blocks in existing debt for year 11, three additional blocks in miner debt taken for year 11, four blocks in operating expenses, nine blocks in 1 GWe to grid revenue, 22 blocks in 1GWe mining revenue

Yearly profits and losses = (9 blocks + 22 blocks) – (10 blocks + 3 blocks + 4 blocks) = 14 blocks

Total Profit = 20 blocks + 14 blocks = 34 blocks

As you can now see very clearly, it would take Beta Labs around 16 years to break even (around 2031) while Alpha Labs broke even in only its second year of operation (in 2023) and year eight from the start of NPP construction in 2016.

Co-location of a bitcoin mining center onsite was truly a game-changing decision for Alpha Labs, thanks to that one visionary engineer who has now been promoted to the executive team. Well deserved indeed.

As we get to see from this case study, co-location of bitcoin mining onsite at the NPP improves both the project revenue and pay back period, which makes the investment capital more attractive. Could bitcoin mining actually help push nuclear power into the mainstream again? Something to think about.

Near-Free Electricity: A Thought Experiment

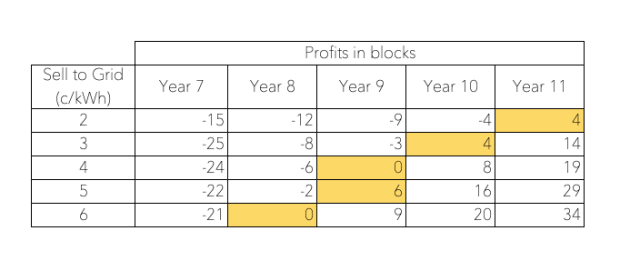

Now, how about we do a little thought experiment and see if Alpha Labs can sell its 1 GWe electricity to the grid at half the price it was selling in the case study before. How would its balance sheet look in this case?

Until year six, there would be no difference, as NPPs are just finishing construction, so we’ll pick up from year seven onwards. Here’s how both companies’ balance sheets look like at the end of year six:

Year Seven: 2022

This is where things get really interesting again. Both Alpha Labs and Beta Labs have completed their NPP constructions and are now ready to produce electricity.

All of our assumptions from the previous case study remain valid for this thought experiment. The only difference is that Alpha Labs is monetizing 1 GWe of its electricity generation by mining bitcoin the exact same way while its 1 GWe portion which it was previously selling to the grid for about $525 million or nine blocks of revenue is now making them half, so about $267 million or five blocks of revenue. This would mean selling at a clearing price of 3 cents per kWh instead of 6 cents per kWh.

Beta Labs: 20 blocks in debt already, five additional blocks in debt for year seven, two blocks in operating expenses, nine blocks in 1 GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 20 blocks – 2 blocks = 18 blocks

Alpha Labs: 40 blocks in debt already, 10 additional blocks in existing debt for year seven, three additional blocks in miner debt taken for year seven, four blocks in operating expenses, five blocks in 1 GWe to grid revenue, 27 blocks in 1 GWe mining revenue

Yearly profits and losses = (27 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 15 blocks

Total debt = 40 blocks – 15 blocks = 25 blocks

Year Eight: 2023

Beta Labs: 18 blocks in debt already, five additional blocks in debt for year eight, two blocks in operating expenses, nine blocks in 1 GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 18 blocks – 2 blocks = 16 blocks

Alpha Labs: 30 blocks in debt already, 10 additional blocks in existing debt for year eight, three additional blocks in miner debt taken for year eight, four blocks in operating expenses, five blocks in 1 GWe to grid revenue, 29 blocks in 1 GWe mining revenue

Yearly profits and losses = (29 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 17 blocks

Total debt = 25 blocks – 17 blocks = 8 blocks

Year Nine: 2024

Beta Labs: 16 blocks in debt already, five additional blocks in debt for year nine, two blocks in operating expenses, nine blocks in 1 GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 16 blocks – 2 blocks = 14 blocks

Alpha Labs: 18 blocks in debt already, 10 additional blocks in existing debt for year nine, three additional blocks in miner debt taken for year nine, four blocks in operating expenses, five blocks in 1 GWe to grid revenue, 17 blocks in 1 GWe mining revenue

Yearly profits and losses = (17 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 5 blocks

Total Debt = 8 blocks – 5 blocks = 3 blocks

Year 10: 2025

Beta Labs: 16 blocks in debt already, five additional blocks in debt for year nine, two blocks in operating expenses, nine blocks in 1 GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 14 blocks – 2 blocks = 12 blocks

Alpha Labs: 18 blocks in debt already, 10 additional blocks in existing debt for year nine, three additional blocks in miner debt taken for year nine, four blocks in operating expenses, five blocks in 1GWe to grid revenue, 19 blocks in 1 GWe mining revenue

Yearly profits and losses = (19 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 7 blocks

Total profit = 7 blocks – 3 blocks = 4 blocks

Alpha Labs has broken even in year 10 in this case instead of year eight, or four years after beginning operation. Still quite amazing considering Beta Labs would not turn profit until year 16 and Alpha Labs is selling 1 GWe electricity at half price compared to them.

Year 11: 2026

Beta Labs: 16 blocks in debt already, five additional blocks in debt for year nine, two blocks in operating expenses, nine blocks in 1 GWe to grid revenue

Yearly profits and losses = 9 blocks – (5 blocks + 2 blocks) = 2 blocks

Total debt = 12 blocks – 2 blocks = 10 blocks

Alpha Labs: 18 blocks in debt already, 10 additional blocks in existing debt for year nine, three additional blocks in miner debt taken for year nine, four blocks in operating expenses, five blocks in 1 GWe to grid revenue, 22 blocks in 1GWe mining revenue

Yearly profits and losses = (22 blocks + 5 blocks) – (10 blocks + 3 blocks + 4 blocks) = 10 blocks

Total profit = 4 blocks + 10 blocks = 14 blocks

Co-location of a bitcoin mining center onsite was truly a game-changing decision for Alpha Labs and even if it sold their electricity at half price compared to Beta Labs, it is considerably more profitable compared to that operation at this stage.

Here is a sensitivity analysis on the clearing price of electricity sold by Alpha Labs and its balance sheet based off of block increments:

As you can see from the table above, in all cases up to 2 cents per kWh, Alpha Labs would turn a profit by year 11 (all highlighted in yellow).

Having worked through the math on both Alpha and Beta Labs’ balance sheets, here are some important things to point out and keep in mind:

- Raising north of $10 billion at 3% interest with the terms outlined in this article for constructing NPPs with bitcoin mining co-location (two heavily misunderstood industries) is no easy task in today’s environment. NPP constructions are very sensitive to the capital cost and cost of capital and it is imperative to get the best terms to build NPPs with mining colocation for long-term profitability.

- NPP constructions can take a long time, around six years for full construction, assuming there are no delays caused due to multiple possible reasons, including public outcry and protests. Compared to this, a natural gas power plant can be up and running in about two years. NPPs are costly to construct and incredibly cheap to operate while the natural gas power plants are the other way around. Given how cyclical and evolving the mining industry is and how competitive it could become over time, it is difficult to project mining revenues six years down the line with any given certainty for raising capital and building capacity expansion upfront for mining onsite.

- Bitcoin mining is going to become incredibly cost competitive over time and revenues are going to shrink to the point where running large mining centers would only be possible behind the meter in some form. Nuclear provides the best case base load for building mining centers for 24/7 reliable energy and no tie in to the grid is required. Even if you are co-locating your mining center with solar or wind, you’ll need some tie in to the grid, since solar and wind are both intermittent sources of generation, unlike nuclear.

- NPP construction costs and timelines might both go down considerably with the advent of modular reactors and next generation reactor types which do not require design and materials of the past, which had led to cost and construction times both ballooning previously.

- The NPP and bitcoin mining model of electricity generation could be adopted by nation states at scale as a matter of energy and national security. These projects could receive state funding and subsidies/credits to make them even more attractive for investment capital.

The intention of this article was to provide a thorough case study on what bitcoin mining co-location with a nuclear power plant construction could look like and how much of a difference it could actually make to the balance sheet of the company owning that generation asset. As we see, you’d rather take the strategy of Alpha Labs than Beta Labs. All you need is one engineer in your company to understand this and pitch it to you.

References

- “The Economics Of Nuclear Energy,” Real Engineering

- “Economics Of Nuclear Reactor,” Illinois EnergyProf

Disclaimer: The information provided in this article is based upon our forecasts and reflects prevailing market conditions and our views as of this date, all of which are subject to change. The article contains forward-looking projections which involve risks and uncertainties. Any statements made in the article are based on the authors’ current knowledge and assumptions. Various factors could cause actual future results, performance or events to differ materially from those described in these statements.

This is a guest post by Puru Goyal and Tina Stoddard. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.