This is an opinion editorial by Enza Coin, a Bitcoin-focused investor and content creator.

Of all countries on Earth, the

Learning The Benefits Of Real Money The Hard Way

My experiences in Yugoslavia were key factors through my formative years that led me into my first investment in bitcoin.

I realized what real money is having lived with Yugoslavia’s famed hyperinflation in the early 1990s. Steve Hanke called this “The World’s Greatest Unreported Hyperinflation.”

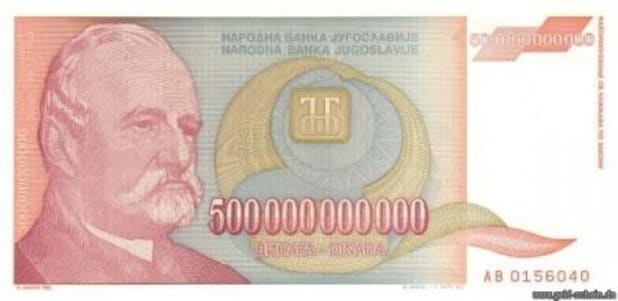

Inflation peaked at 313,000,000% per month, or 116,000,000,000% per year. The National Bank of Yugoslavia started printing a 500 billion dinar note. I recall my father giving me a stack of dinar paper notes to play with as a child and telling me to simply crumple them into a big ball and practice some basketball shots with my brother, an aspiring basketball player (who is now 6’ 8” and does play). This seemed strange to me at the time, but my father explained that the government had printed so much that the money was worthless. He said that money shouldn’t be created on the whim of the government to use it for its abuses. I guess this taught me what real money needs to be… Bitcoin.

Money Should Have A Limited Supply

Before the central bank printing press inflation really kicked in, my father lent a neighbor 1 million dinar to help him buy some land in 1990. The agreement was to repay it within a couple of years. However, in a not-so-neighborly response, the neighbor did repay the loan plus interest, but chose to do so after major, inflation-induced devaluations of the dinar through 1993. My father said that the million dinar was not even worth enough to buy an orange. Oddly, he really did refer to an orange. Perhaps this was a foreboding that someday I would be orange pilled.

Money Should Be Immune To Seizure

As with everyone in the fiat world, you needed a bank account to live in Yugoslavia. But it was a running joke within the country that everyone’s main hobby was to open bank accounts outside of the country, in places like Austria, Germany and Switzerland.

Earnings from jobs outside of the country were kept in foreign banks and any money earned locally was converted into Deutsch marks, Austrian schillings and Swiss francs as quickly as possible. Regardless, we still needed to hold some money in local banks. This money was lost to eternity, due not only to deposits being frozen by the government, but also due to complications from the breakup of Yugoslavia (which included splitting up its banks).

The breakup led to fights over succession of the country’s assets and liabilities by the newly-independent countries and the dissolution of legacy institutions. Legal fights over obligations and their legal successors are still being fought today.

Similarly, I recall the day that my father was to go to the bank with an intention to withdraw all his remaining savings. He became busy with another task and said that he would go the next day. Unluckily, the next morning, it was announced that all deposits were frozen. One day of inadvertent procrastination cost a small bundle. This taught me to not only get things done quickly, but to ensure that I diversify my wealth. This is why I find Bitcoin’s self sovereignty to be one of its most desirable advantages.

Bitcoin Promotes Peace And Freedom

They say that if Bitcoin were adopted by more countries, it could help stop wars inspired by fiat-printing-press-funded governments that are incentivized to support military-industrial complexes and self-serving policies of politicians.

I wish that Bitcoin would have been created 20 years earlier and adopted by Yugoslavia. Perhaps this could have prevented the wars and the breakup of the country. Some 140,000 people’s lives might have been saved.

My memories of the sights and sounds of the war are vivid, from recollections of explosions shaking the windows of my family’s home to cancellations of school. On top of this, the U.S. and other NATO countries believed that they had the moral standing to sanction and embargo all of the countries of the former Yugoslavia. Sanctions, inspired by fiat printing presses and the military-industrial complex, simply led to us standing in lines to buy certain foods, the absence of some medications and even seeing NATO planes dropping bombs overhead. Sanctions impact the masses, not the elites who flee with their pockets full of fiat. Fortunately, for the rest of us, now there is Bitcoin.

Bitcoin Supports A Better Future

What I experienced growing up stays with me today and partly drives my motivations in life and my move to Bitcoin. When I first learned about Bitcoin and saw how it could help promote democracy and economic stability, I realized that its game-changing technology is a way for the 99% to fight back against tyranny.

My investment today in bitcoin means more to me than just having financial security. In some way, I feel that with each sat I buy, I can help the world work to a better future, avoiding the sorrows and mistakes of the past like those experienced in the former Yugoslavia. Remember what George Orwell wrote in his book “1984”: “We shall meet in the place where there is no darkness.” To which I will add that a place in the light is the world of Bitcoin.

This is a guest post by Enza Coin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.