There has been a lot of digital ink spilled about the concept of Bitcoin Maximalism, but there are things the critics don’t understand.

This is an opinion editorial by Stephan Livera, host of the “Stephan Livera Podcast” and managing director of Swan Bitcoin International.

It’s time to clear a few things up. While there has been a lot of digital ink spilled over the years debating the concept of Bitcoin Maximalism, we seem to be going back to some of the same arguments over and over — notably in Nic Carter’s

And What Of Stablecoins?

As for stablecoins, aren’t they just crypto-fiat? Firstly, the name is a bit misleading. They’re not really so stable, more just steadily declining, just like fiat currency is over time. Secondly, most people accept that for now, fiat is still dominant and that stablecoins may form part of the process of slowly shifting the world to a bitcoin standard. I could see pathways where some new users (often not in the Western world) start using stablecoins and then slowly transition over to using bitcoin once they are more comfortable.

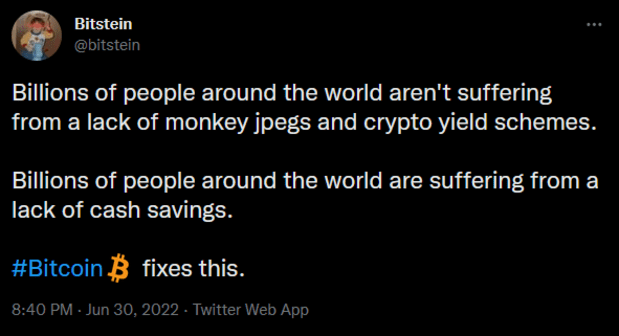

No matter how good stablecoins are for short-term payments, they are still not suitable for long-term savings. Stablecoins track fiat currency, which is continually decreasing in purchasing power. A key part of the case for Bitcoin maximalism is that billions of people around the world need something they can save with. This savings demand is also known as reservation demand, and it is a key component in the process of an asset becoming money.

On the other hand, it’s also possible to see government regulatory action or legislative action come that regulates stablecoins in such a way that they lose their relative ease of use. For example, this could happen if stablecoins were to be regulated as money market funds, or with additional banking regulations that required KYC on every step of stablecoin use, or if private stablecoins were regulated heavily in favor of promoting government-issued central bank digital currencies (CBDCs). At that point, it would become even more clear that Bitcoin is uniquely censorship- and inflation-resistant.

Is Bitcoin Maximalism Boring?

Is Bitcoin Maximalism boring or is it just consistent? Maybe savings shouldn’t be so “exciting,” anyway. What the world needs is definancialization, and part of that is the long-term process of sucking out the “monetary premium” that is currently held up in physical properties, stocks or bonds. Over time, we anticipate more people to choose Bitcoin, or “defect to” Bitcoin, if you like. Instead of stacking bonds, index ETFs or properties, people will stack sats.

While savings might be “boring,” if we’re talking about exciting things, why not consider the impact that sound money would have on the world? There are all manner of sociological impacts that will come from bringing about non-state money. This is because fiat money changes culture. A lot of the altcoin projects seem more like chasing the next shiny thing, and they like to move fast and break things — but Bitcoin as a movement is about civilizational infrastructure.

“But There Are Lots Of Other Chains With Demonstrated Value”

So, the claim that altcoins have demonstrated throughput or fees paid represents the protest of altcoiners that there are meaningful uses of altcoin chains and financial services being provided in a decentralized way. They argue that this will be a multi-chain world and some even go so far as to say that Bitcoin will be flippened because this activity is not taking place on Bitcoin.

But really, how much of this was just because of the shitcoin casino factor? The leverage casinos can definitely pull a crowd, but is that the crowd that matters? Will these be the people who HODL through the big drawdowns, and stack consistently? Will these be the people who build companies, code and review software or build hardware that helps advance the Bitcoin monetary revolution?

Altcoin promoters and apologists will point to the volume of transactions, fees paid, or total value locked (TVL), and the use of cross-chain “bridges” as to why it will supposedly be a multi-coin future. Some will argue that altcoins are building up an “economic engine.” But from the Bitcoin monetary maximalist POV, there’s little reason to continue holding utility coins anyway.

See this critique of utility coins by Adam Back, CEO of Blockstream:

It may well be that people use different rails to transfer value, but the Bitcoin revolution is very much about growing the base of HODLers/stackers/savers. Just like how you can use Zelle or PayPal or Cash App to send USD, the thing that helps the USD is that there are lots of people who want to hold it, and people who price their deals and exchanges in USD.

So even if there is a lot of transactional flow on altcoin chains, or even if lots of stablecoins are flowing via altcoin chains, what matters is that bitcoin’s scarcity and overall qualities are valued by people. Even if bitcoin is “held on” Binance Smart Chain in a “smart contract,” how is this meaningfully different from say, bitcoin held by a custodian such as Coinbase, BitGo or the like? At the end of the day, all of Bitcoin’s coins are existing on Bitcoin’s ledger, there are just different custodians of it. The number of people HODLing bitcoin and wanting to stack it is what matters most.

Bitcoin The Tool And Bitcoin The Movement

Running with this idea from Sergej Kotliar of Bitrefill, it’s important for us to understand the difference between neutral “Bitcoin the tool” users, and those who are ideologically aligned with the Bitcoin movement (broadly speaking: cypherpunks and libertarians). Just as there are millions of BitTorrent users who would never go to a BitTorrent conference or consider themselves part of the “BitTorrent movement,” there are Bitcoin users who are similar.

They use Bitcoin tools just by searching online for “best bitcoin wallet” or they use the already existing wallet by their providers e.g., blockchain.info wallet, as that has been around for ages. They even use shitcoin wallets like Exodus. Now, as maximalists and members of “bitcoin the movement,” we can certainly have our views about shitcoin wallets and companies that aren’t popular among Maximalists in the space (Blockchain.info or Coinbase as examples). But we do have to accept the reality that currently, shitcoin casinos have a lot more users. They may currently be able to drive more new users into shitcoin wallets than we can funnel into bitcoin-only non-custodial wallets. At least, for now.

How Bitcoin The Movement Still Wins

The main things that altcoins can’t match are the monetary properties and decentralization of Bitcoin. But in addition, they can’t match the size and quality of the Bitcoin movement. There are Bitcoin meetup groups around the world, developers working to advance the protocol and applications, peer-to-peer bitcoin trading in many cities and miners distributed around the world.

Many people work to advance Bitcoin’s adoption because they believe it is the right thing to do. As a community of advocates, educators, builders — we do have the ability to drive the direction in terms of what gets built out, and the products and services that get taught to newcomers, especially if they are our family and friends. Altcoin communities are nowhere near as stable because the alts are so fickle, one day they are pumping 10 times, and the next it’s all gone bust or imploded. While the vast majority of altcoins that pump are basically one-hit wonders, as explained by Sam Callahan and Cory Klippsten of Swan Bitcoin, Bitcoin remains and carries on growing over time.

While there are lots of users who aren’t strongly engaged with the movement, they do end up benefiting from the things done by “Bitcoin the movement.” I believe driving adoption of non-custodial scaling technology and privacy technology will be done by ideological Bitcoiners who want to ensure that Bitcoin remains freedom technology. And the benefits will flow down later to the “neutral” users who don’t really care that much either way.

Summing Up

So in summary, Bitcoin Maximalism is the view that we’ll live on a bitcoin standard. Maximalists want to clearly distinguish Bitcoin from “crypto.” They are focused on development, building, education and community growth. There is pressure not to shitcoin scam or shitcoin grift, and this is generally done for the sake of retail consumer protection. Other projects may exist, and they may even attempt to interoperate or connect with Bitcoin in some way, but ultimately, this is about the Bitcoin monetary revolution.

Thanks to my friends Michael Goldstein (aka Bitstein) and Giacomo Zucco for their feedback on this article.

This is a guest post by Stephan Livera. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.