Israel’s New Study Shows 51% of Public is Interested in Adopting CBDC (Digital Shekel) – Is That So?

On April 1st, at the KPMG offices in Tel Aviv, several dozen people gathered for a meeting of the “CBDC IL Forum” to hear representatives from academia, the Bank of Israel, and KPMG present findings from a study conducted by the Bank of Israel through “Roschink” research institute. The study included around 1,000 participants, and the results were published on the Bank of Israel’s website. In this article, I will review key points from the meeting, comment on the research published by the Bank of Israel, and share what I had said to attendees at the end of the forum meeting.

Study: The Israeli Public’s Willingness to Adopt a Digital Shekel

Dr. Nir Yaacobi from the Digital Shekel team at the Bank of Israel shared that participants in the study were randomly selected and represent all population segments. “The research institute works with these individuals, and they are paid for their participation,” he said. The amount paid was not disclosed. Prof. Ruth Plato-Shinar, one of the study’s authors, mentioned that the questionnaires were in a digital format. She noted that even people with very basic phones could participate, but acknowledged that those without any digital access likely did not participate and probably don’t understand what a digital shekel is.

Analysis of the study document reveals several methodological issues:

- Sampling method: An online panel was used, meaning participants were already enrolled in digital survey platforms—potentially biasing the sample toward tech-savvy individuals and skewing attitudes about a digital currency.

- Sample representation: The random sampling underrepresented certain groups, especially Arab citizens. Reweighting was used to correct this by doubling responses of some participants, potentially compromising authenticity.

- Risks such as loss of privacy, government overreach, and impact on cash economies may be underrepresented due to a bias toward digitally-inclined respondents.

- Participant dropout: 115 participants dropped out between the first and second questionnaires, which may indicate a selection bias—those more interested in the topic stayed on.

Despite efforts to ensure a representative sample, these methodological limitations may affect the study’s validity.

Avoiding Disclosure of Digital Shekel Risks

At the end of the meeting, I spoke critically about the partial and mainly positive information presented to study participants and the CBDC IL Forum attendees. The public wasn’t exposed to potential risks and limitations of such a system, which I’ve elaborated on in many of my keynote speeches, articles and podcasts.

The following video shows that the way the digital shekel was presented to study participants was lacking. The description of the digital shekel and its system focused on the advantages, as read by Prof. Plato-Shinar at the CBDC IL forum meeting:

In addition, the study does not comprehensively address potential risks for end users—such as the possibility of state control over financial behavior, loss of privacy, asset seizure, use of the currency as a surveillance tool, restricted access to funds due to regulatory decisions, and more. The lack of emphasis on these risks is especially problematic for individuals concerned about government overreach and privacy violations, but also for those who are simply unaware of the potential dangers and their implications.

The study does mention:

- Limited privacy claims: It is stated that “the central bank will not have access to identified information about balances and transactions in users’ wallets,” but also that privacy levels will be defined according to user type—which implies that privacy is not absolute.

- Enforcement capabilities and restrictions: “The system will support the implementation and enforcement of restrictions” on wallet balances, which could indicate the potential for usage limitations. The digital shekel is being designed with technical capabilities to impose limits on wallet balances—meaning it will be possible to define how much money a person is allowed to hold in their digital wallet and monitor that in real time. Although the document does not specify who would be authorized to enforce these limitations, the mere existence of enforcement capabilities indicates a control mechanism that could theoretically allow freezes, blocks, or other restrictions on usage—raising questions about financial freedom, privacy, and institutional power.

- Government control: The Bank of Israel will be “the sole authority empowered to issue and redeem the digital shekel,” meaning there will be no decentralized alternatives like cryptocurrencies such as Bitcoin.

Implications for Cash-Based Communities

The study does refer to the level of interest among different population groups and notes that among the ultra-Orthodox community, interest in the digital shekel is among the lowest. However, it does not explicitly discuss the consequences of transitioning to a digital currency for communities that rely heavily on cash. The digital shekel may pose a significant challenge to these groups if cash usage is eventually curtailed.

Possible reasons for low interest among the Haredi (ultra-Orthodox) community:

- Clear preference for cash: Most Haredim use cash due to privacy concerns, a desire to avoid dependence on banks, and some hold traditional opposition to modern financial systems.

- Digital literacy gaps: Financial digital literacy in parts of the ultra-Orthodox community is lower than the general population.

- Fear of regulatory control: Cash offers a degree of economic independence, whereas a digital shekel may increase government control over payments.

Senior Citizens

In 2023, the Israeli Internet Society conducted a survey among Israelis aged 65 and older. It found that approximately 30% do not use the internet at all, and “it can be said that at least some of them have not bridged the access gap.” This population segment (60+) comprises around 25.3% of Israel’s total population (data from 2020). This is another example of a group whose access to technology is limited—and therefore will likely also be limited in their ability to use a digital shekel.

Since the study was conducted digitally, that 30% segment of this population likely was not represented in the sample. That said, only 13% of the study participants were aged 60+ (13% in the first survey and 12% in the second), meaning people aged 60 and over were underrepresented in the sample—at about half their proportion in the general population.

This raises several concerns:

- Digital exclusion: A significant portion of those aged 65+ simply could not participate in the survey.

- Overestimated tech readiness: If only elderly people with digital skills participated, the study may overestimate interest among the elderly.

- Accessibility gaps: People who struggle with technology may also struggle to use the digital shekel—but their perspectives were not captured.

All of these factors may introduce bias that should be taken into account when interpreting the findings. To achieve a more accurate picture, the researchers could have incorporated other research methods (such as phone or in-person interviews) to reach those without digital access.

What’s New in the World of CBDCs

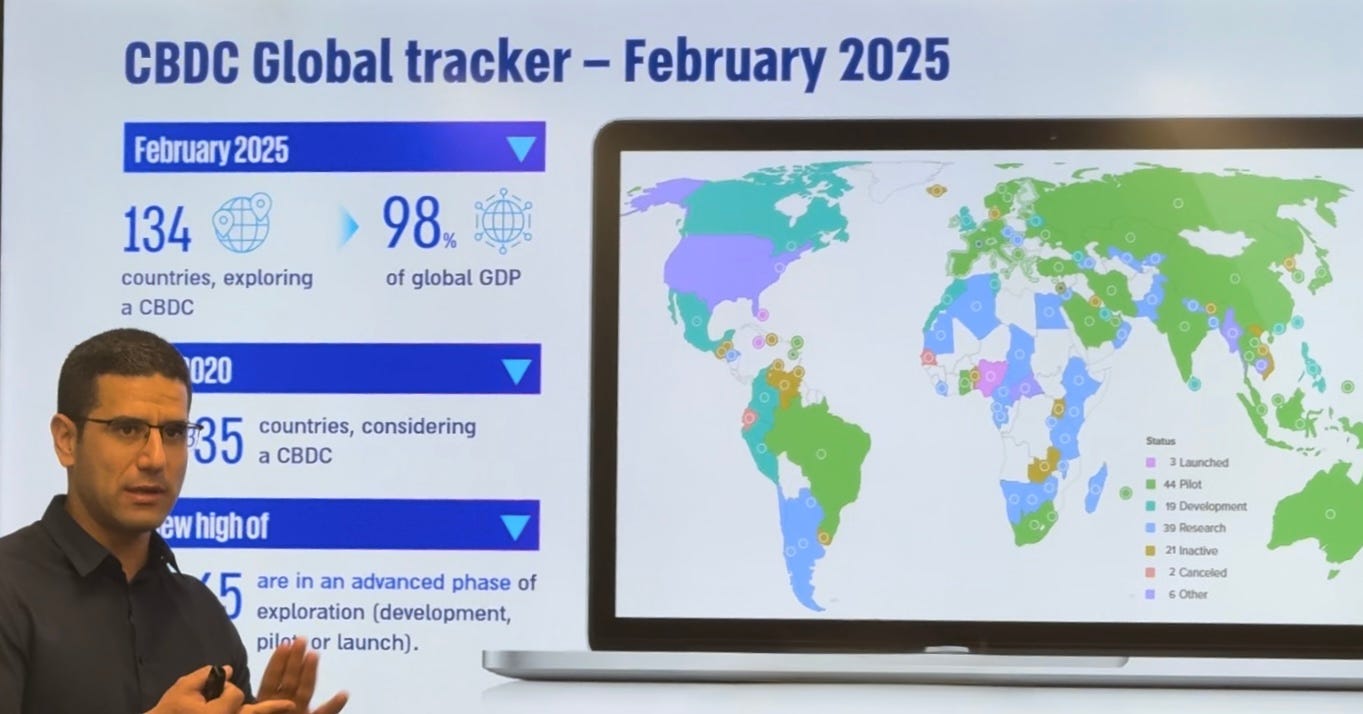

At the meeting, Ben Benakot of KPMG Israel presented developments in the CBDC space. He noted that most countries in the world are exploring CBDC solutions at various stages, and that 65 countries are in advanced research stages.

One case study he presented was Brazil, where the central bank launched the PIX retail payment system during the COVID-19 period. It saw rapid adoption. Today, Brazil’s central bank is working on DREX, a wholesale CBDC system, and has completed a collaboration with Meta to enable payments via WhatsApp using PIX.

Ben pointed out that no advanced Western countries have launched CBDC systems yet—likely one reason the Bank of Israel is not rushing to make a decision. The Bank of Israel has previously stated it is monitoring the EU central bank as a model.

Balancing the Narrative on the EU and China

In my closing statements at the CBDC IL forum meeting, I also referred to a study conducted recently in the EU with less than flattering results; This study was clearly not mentioned by any of the forum’s experts. I found it important to balance the overly positive narrative and bring the following to attendees’ attention:

On March 12, the European Central Bank (ECB) published a working paper titled “Consumer Attitudes Toward CBDC,” surveying approximately 19,000 respondents across 11 Eurozone countries. The report highlighted significant communication challenges that are expected to hinder adoption of the digital euro. It found that Europeans show little interest in a digital euro, strongly prefer existing payment methods, and see no real added value in a new payment system given the many alternatives.

Nevertheless, the European Central Bank recently announced that it will begin the rollout of the digital euro in October 2025, pending regulatory approvals.

Read more about the EU’s CBDC plans in my recent article, ECB Prepping the Ground for Digital Euro Launch.

Furthermore (at the CBDC IL meeting), I went on to explain that the high adoption rate of the CBDC in China is not necessarily a result of public enthusiasm, but rather of a top-down market strategy led by the central bank—a “If you can’t beat them, join them” approach. In the early years of the e-CNY (China’s CBDC), the project was considered a failure due to low adoption. Eventually, the central bank instructed major retail and tech companies to integrate e-CNY into their most popular apps (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay)—a move that enabled wide adoption. Today, the e-CNY has about 180 million digital wallet users and a cumulative transaction volume of $1 trillion.

The Trust Factor

70% of Israel’s study participants expressed trust in the Bank of Israel. At the meeting, Ben Benakot of KPMG commented on the trust issue: “If we don’t trust the government, this becomes a problematic issue, because theoretically, CBDCs give the state more data.” Benakot noted that although the Bank of Israel is designing the system so that it won’t have direct access to user information—only authorized payment providers will—there’s no guarantee that a future government won’t change the system and gain direct access to accounts and personal data.

He also mentioned that today, for example, the Israeli tax authority already has the ability to monitor financial data on citizens (albeit not immediately or directly due to oversight). In theory, the digital shekel is not very different.

Public Awareness and Messaging

Another point I raised at the meeting was the Bank of Israel’s responsibility to inform the public in a fair, honest, and balanced way. I asked: if the Bank truly seeks to understand the public’s willingness to adopt the digital shekel—why hasn’t it launched a nationwide campaign like it did during Covid-19, when the government mobilized all its resources to educate the public through experts, influencers, media, social platforms, billboards, and more?

Why, unlike during Covid, isn’t the Bank of Israel making an effort to present the full picture—including the risks and downsides—not just the flattering, positive aspects?

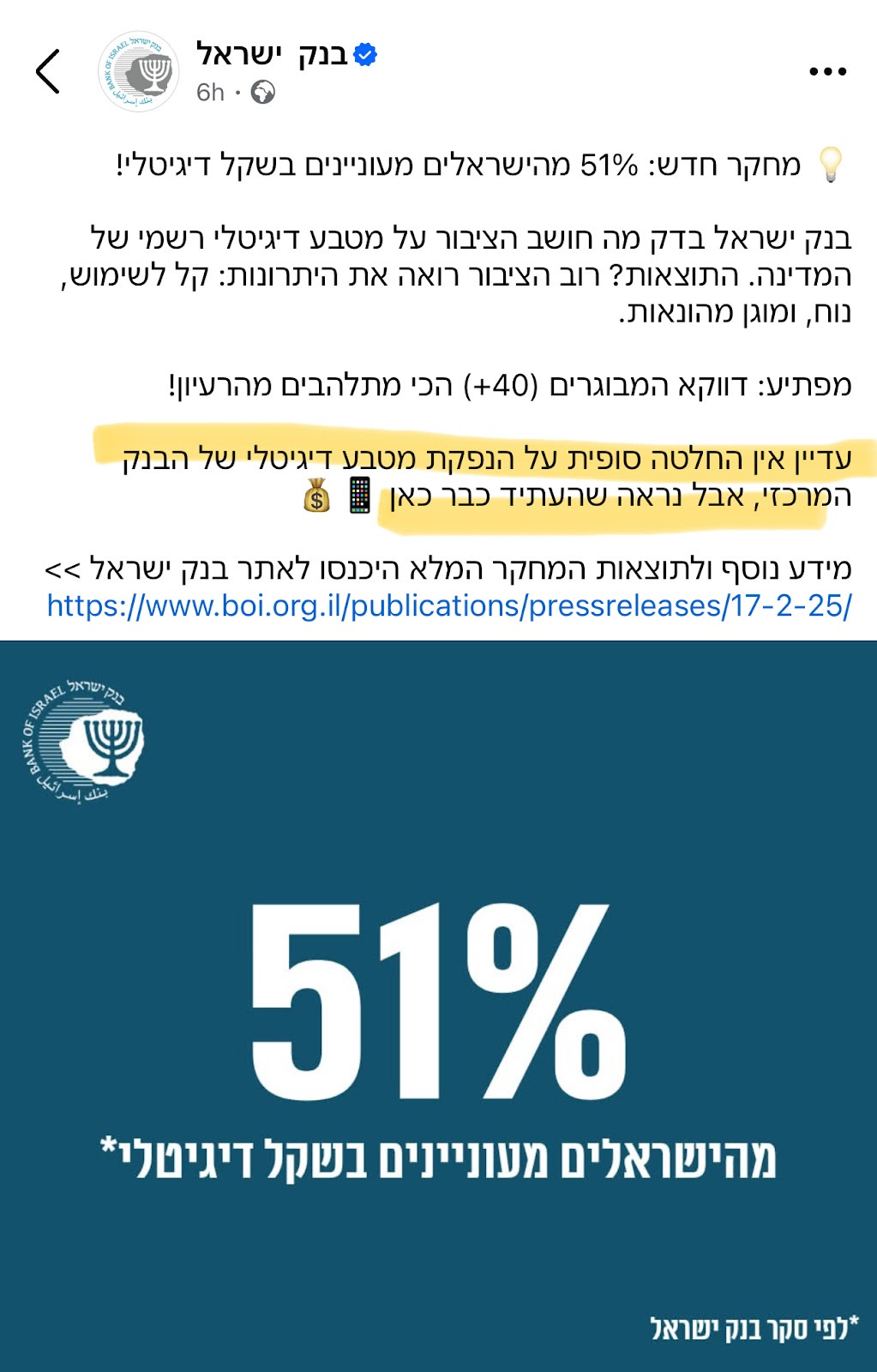

As someone with about 20 years of experience in marketing, I also pointed out the haste with which the Bank moved from releasing the study and press announcement, to publishing a post the very next day (!) on social media (Instagram, Facebook) stating: “51% of the public wants a digital shekel.”

Every beginner marketer knows that when you highlight the yes, you obscure the no. Yes, there’s interest—but what about the other 49%?

The post read: “Most of the public sees the benefits: easy to use, convenient, and protected from fraud.” Most of the public? Based on a 1,000-person study where 51% expressed interest?

It also states: “No final decision has been made, but it seems the future is already here.” That sounds like the decision’s already been made—only the launch date is missing.

Conclusion

Dr. Nir Yaacobi from the Bank of Israel’s Digital Shekel team said at the meeting: “We’re entering uncharted territory, and we don’t currently have a strategy”—referring to which digital financial solution will be chosen in Israel.

“We’re working on three fronts: a digital shekel (CBDC), stablecoins, and tokenized commercial bank deposits.” He added: “Maybe we’ll go with one solution—like the digital shekel—or maybe all three. If we launch a wholesale CBDC, legislation likely won’t be needed. If it’s retail—yes.”

After I finished my remarks, Assaf David-Margalit from the Digital Shekel team responded and said that some of what I said was accurate—but most of it was not. When I asked what wasn’t accurate, I received no response. My invitation to Mr. David-Margalit to respond with specific clarifications remains open.

To conclude: I believe it is vital to raise public awareness around the digital shekel, because clearly “the future is already here.” For that reason, it is essential to openly present both the risks and benefits of a digital shekel system so that an informed public can participate meaningfully in the conversation and make relevant choices about their lives.

This is a guest post by Efrat Fenigson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post Israel’s New Study Shows 51% of Public is Interested in Adopting CBDC (Digital Shekel) – Is That So? first appeared on Bitcoin Magazine and is written by Efrat Fenigson.