“Ponzi scheme” has become a byword for all manner of financial frauds and monetary scams. When a rapid six month collapse erased $2T (trillion) from crypto market capitalization in 2022, mainstream media outlets were quick to again label cryptocurrencies, including Bitcoin, Ponzi schemes.

Writing in the Chinese People’s Daily online edition, Shan Zhiguang and He Yifan, representing the Chinese Blockchain-based Services Network (BSN), claimed:

Ever since Satoshi Nakamoto released “Bitcoin: A Peer-to-Peer Electronic Cash System” in 2008, leading to the official birth of Bitcoin, the debate surrounding virtual currency (Cryptocurrency) has never stopped for a moment. [. . .] In its essence, the author believes that virtual currency is undoubtedly the largest Ponzi scheme in human history.

Can Bitcoin be legitimately described as a Ponzi scheme? If so, is it really the largest Ponzi scheme in history? In the rapidly developing world of tokenised assets and digital currencies, the answer is not as straightforward as you might think. In fact, we are faced with a Bitcoin paradox.

The Origin of “Ponzi Schemes”

The Dictionary of Idiomatic English Phrases, published in 1891, claims that the etymological root of the the phrase “rob Peter to pay Paul,” meaning to take what rightfully belongs to one person to pay another, is founded in English folklore:

In 1540 the abbey church of St. Peter’s, Westminster, was advanced to the dignity of a cathedral by letters patent; but ten years later it was joined to the diocese of London again, and many of its estates appropriated to the repairs of St. Paul’s Cathedral.

There is some dispute and evidence suggesting “rob Peter to pay Paul” was in common usage before the 16th century. Later dictionary definitions specify that the phrase means “transferring money from one group of people or place to another, rather than providing extra money.”

If we apply this to bank deposits, which are bank liabilities, then bank borrowing represents a variation of the process. We could rephrase it “use the debt owed to Peter to lend to Paul.” If we then consider a fractional reserve banking system, and the likelihood that Paul’ money will also be banked, then the whole deposit, lending and debt creation process—we call it the fiat monetary system—starts to look distinctly fishy.

The idea of taking money from some to pay others, has enabled many frauds and scams over the centuries. If the prospective victims can be encouraged to forgo pecuniary caution, then the fraudsters are on to a winner. Providing their fraud isn’t exposed and they don’t get caught.

Sarah Howe opened the Ladies’ Deposit Company in 1879. Operating out of Boston, Howe offered her exclusively female clientele an enticing 8% monthly compound interest, promising to return $96 profit on an initial $100 deposit in the first year.

In a highly misogynistic society, where women’s access to finance and banking was limited, Howe pitched her banking business by appealing to women’s sense of injustice. Claiming effective charity status, she told unsuspecting depositors that she was bankrolled by wealthy Quakers and their deposits were safe. None of this was true.

No one was covering Howe’s operation. She was paying dividends to early investors directly from the deposits she had taken from her other customers. Howe’s fraud was exposed and most of the women who believed her, and in the cause she claimed to support, either lost their savings or a considerable proportion of them.

Howe served a three year sentence and, upon her release, embarked upon practically the same scam again before being imprisoned a second time. Howe’s favoured fraud would later become known as a “Ponzi scheme.”

The Ponzi Scheme Takes Shape

Less than two decades after Howe’s downfall, in 1898, William Miller, who became known to many as “520% Miller,” started an investment scheme that promised investors a huge percentage return on their initial deposit. Aged just 21, by all accounts, Miller was a poverty stricken office clerk with a young family to feed. Having failed miserably in his white collar career and with no notable blue collar skills, Miller turned to the only thing he thought he could make money from: finance.

Miller regularly frequented “bucket shops” where those on lower incomes would effectively bet on activity in the stock and commodity markets. While, in reality, no stocks or commodities were exchanged, as a “bucketeer,” Miller studied market form like racing enthusiasts study horses. Miller was hopeless at this too and regularly lost his meagre earnings in the bucket shops.

Miller somehow ingratiated himself among the flock of the Christian Endeavor Society of the Tompkins Avenue Congregational Church. He first convinced Oscar Bergstrom and two other churchgoers to invest, what was then, the not inconsiderable amount of $10 each into his insane financial proposition. Promising them a 10% weekly dividend—an annual return of 520%—Miller convinced his victims that he was such an astute investor, he could not only indemnify their initial investment but provide them easy riches in return.

If they reinvested their weekly dividend, Miller was offering them compound interest that would ultimately provide a windfall of $1,420, for their initial $10 deposit, in the first year. Anyone who understood either markets or finance would have quickly realised this was a quite ludicrous proposal. It seems Miller preyed upon people with a very limited grasp of finance. This is common feature of nearly all Ponzi schemes.

Miller’s scheme took off because he seemingly delivered. His early depositors made the returns he promised. Within months, Miller’s magic money making machine had become the talk of Brooklyn, then New York and soon the entire United States. Naming his scam “the Franklin Syndicate,” the money poured in from across the country.

Unfortunately, for most of his investors, it was all a ruse. Miller was paying dividends and cash outs from the money he had accumulated from every other investor. His gambit was to hedge that not all of his investors would cash out at the same time. While they didn’t, providing withdrawals remained relatively low, he could cover the payments. You may have spotted that Miller’s scheme was not dissimilar to fractional reserve banking in this regard.

While the Syndicate made some investments, there was no underlying portfolio that could even remotely cover any kind of run on Miller’s operation. His entire scheme was based upon perpetual and significant deposit growth. A slow down of incoming investors would leave Miller with an unsolvable liquidity crisis. The Franklin Syndicate was a fraud.

When this was exposed in the press, Miller fled to Canada before being arrested and extradited back to the US. Despite a protracted legal dispute, involving successful appeals, which were then reversed, and a dizzying array of accusation and counter-accusation among the scam’s protagonists, Miller, who was also nicknamed the “the Boy Napoleon of Finance,” was nonetheless imprisoned in Sing Sing prison. Upon his release, Miller went straight and garnered yet another moniker: “Honest Bill.”

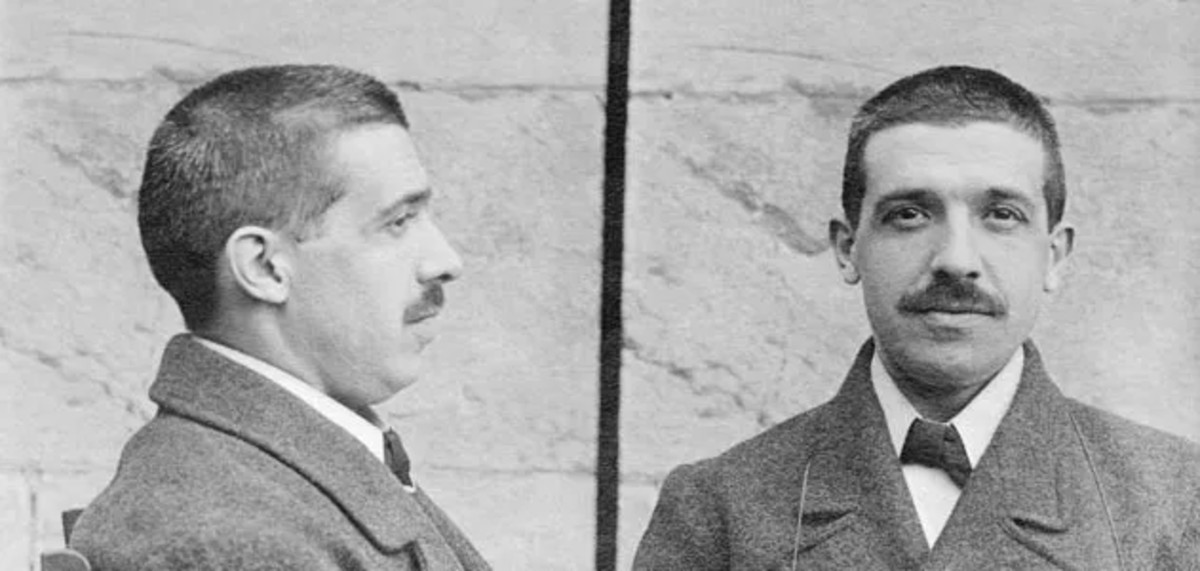

While it seems highly likely, it isn’t absolutely clear if Carlo Pietro Ponzi, better known as Charles Ponzi, was familiar with either Howe’s or Miller’s scams. What can be said is that he emulated their model of financial fraud and took it to new heights. Consequently, he will forever be remembered for his “Ponzi scheme.”

Born in Lugo, Italy, in 1882, Ponzi arrived practically penniless in Boston in 1903. By the time he embarked upon his Ponzi scheme, he had already been convicted for fraud, in Canada and, what we would today call, “people smuggling” in the US.

As a young man in Italy, Ponzi worked for the postal service. This perhaps influenced his decision to initially launch an entirely legal arbitrage business.

Ponzi reportedly received a letter from Spain with an “international reply coupon” (IRC) included. Ponzi noted that the IRC price paid in Spain was considerably less than the face value of the US stamp he could purchase with the it. He set about exploiting the international price difference for legitimate profit by selling foreign IRC purchased US stamps to US customers. Ponzi established “the Securities Exchange Company” for his venture.

While theoretically viable, Ponzi’s arbitrage profit margins relied upon him undercutting the US post office. His potential customers could buy the stamps practically everywhere and had no inducement to buy from him otherwise.

His margins were further restricted by unfavourable fluctuation in exchange rates, advertising costs, delivery and supply costs and he required significant trade volume to provide himself with any kind of substantial income. In other words, if he was going to earn a living from his idea, hard work was necessary. Evidently, this wasn’t something Ponzi was too keen on and his ambitions went far beyond running a small business.

Unlike Miller, who simply claimed he was a financial wizard, Ponzi recognised that he could lend some authenticity to his fraud by basing it upon, what at least appeared to be, a plausible business idea. Ponzi decided to make up some wild, unfounded claims about the success of his international arbitrage operation and focused upon attracting as many investors as possible.

Claiming the need to maintain competitive advantage, Ponzi said he couldn’t disclose the precise details of his method. A broad outline of his business plan was sufficient to convince a throng of investors. He offered them a 50% profit, first within 90 days and then later, to increase the pace of incoming deposits, within 45 days.

Ponzi’s scheme was, in all other respects, identical to Miller’s and Howe’s. Payments were made as promised to early investors from the deposits hoovered up from all the others. Healthy dividends paid to a minority convinced the majority to reinvest and never cash out, thus enabling Ponzi to rapidly expand. Taking the bulk of his gains for himself, Ponzi knew where the real money lay and so sought to buy a controlling interest in a bank.

Ponzi targeted the Hanover Trust bank which had turned down his $2000 business loan request only a year earlier. Once the fraud was finally reported by the press, in the summer of 1920, his “Ponzi scheme” collapsed in short order. Charles Ponzi’s exposure elicited a terminal run on Hanover Trust which also held a $125,000 deposit from the Commonwealth of Massachusetts, leading to the resignation of State Treasurer Fred Burrell.

Ponzi’s inexorable march towards another prison sentence probably wasn’t helped when “520% Miller” was quoted by the New York Times, just days before the complete implosion of Ponzi’s company, saying:

I may be rather dense, but I cannot understand how Ponzi made so much money in so short a time.

Ponzi faced two federal indictments on a total of 86 counts of mail fraud. He served three and half years of five year term before being re-indicted for larceny by Massachusetts state prosecutors shortly after his release. Ponzi sued, claiming this was a breach of the plea bargain he had made with federal prosecutors. The effective “double jeopardy” argumentation went all the way to the Supreme Court and Ponzi lost. In between his periods of subsequent incarceration, there were appeals, stints on the run, assumed fake identities, additional Ponzi schemes and other frauds. Eventually Ponzi was deported back to Italy in 1934.

Ponzi was a flamboyant character who, despite his crimes, enjoyed some remaining popular support which dwindled as his legal disputes dragged on. But his Ponzi schemes and frauds weren’t victimless. Many people, especially in the Boston Italian community, lost their life savings to Ponzi. While accounts vary, the total estimated losses of the first named “Ponzi scheme” were between $15M – $20M. Equivalent to between $231M – £308M today.

Ponzi’s wife, Rose Gnecco, stayed loyal to him throughout his undoing. When he was finally deported to Italy, Ponzi had reportedly swindled Rose and her family out of $16,000.

Allegedly the Largest Ponzi Scheme In History

In 2021, claiming Bitcoin was a Ponzi, the Brazilian computer scientist, Jorge Stolfi, defined the five primary characteristics of a Ponzi scheme.

People invest into a Ponzi scheme primarily because they expect good profits, and:

- that expectation is sustained by such profits being paid to those who choose to cash out. However,

- there is no external source of revenue for those payoffs. Instead,

- the payoffs come entirely from new investment money, while

- the operators take away a large portion of this money.

Ponzi schemes are always too good to be true. A modicum of due diligence should deter those wary enough to exercise some. Regardless of Stolfi’s arguments about Bitcoin—we’ll examine them in more detail shortly—in order for a Ponzi scheme to succeed, in addition to a degree of financial gullibility, the investor falls prey to the fraudster because they “expect good profits.”

So while there are victims, the individuals who lose their shirts aren’t entirely “blameless.” They exhibit what former US Federal Reserve Chairman Alan Greenspan called “irrational exuberance.” Obviously, this in no way exonerates the fraudster.

That didn’t stop Bernie Madoff—perhaps the most notorious exponent of the Ponzi scheme other than Ponzi himself—from levelling the accusation of greed at his victims. In March 2009, Madoff pleaded guilty to 11 federal charges, including money laundering and securities fraud, and was sentenced to 150 years. He died in prison in 2021, aged 82.

Following his conviction, Madoff’s family suffered a string of tragedies. In 2010, Bernie’s son Mark committed suicide. In 2014 his other son, Andrew, died from a very rare form of cancer and, in 2022, Bernie’s elderly sister, Sondra Wiener, and her husband Marvin both died in an apparent murder-suicide.

It is frequently stated that Madoff operated the largest Ponzi scheme in history. For reason’s we’re about to discuss, that claim is dubious.

Madoff served as Nasdaq’s chairman in 1990, 1991 and 1993, and was arrested in 2008. By then his Ponzi scheme had been running for at least 20 years and prosecutors estimated the scale of his fraud, based upon 4,800 known client accounts, to be $65B. The total lost principle was finally estimated at $19.4B. Unusually, for a collapsed Ponzi Scheme, nearly $15B of the principle has been recovered for some investors.

The US Securities Investor Protection Corporation (SIPC) protects investors against losses to fraud, but only if they unwittingly invested directly in the scam. Unfortunately, 80% Madoff’s Ponzi scheme victims came from “feeder funds” or investment pools and were deemed third parties. As such, many of the relatively small investors were not eligible for SIPC protection. Larger depositors, such as institutional investors, were relatively well protected and have retrieved most of their investment, though not their profits.

Those who withdrew more than they put in—net winners—were required to repay the difference. This left the vast majority of Madoff’s small-time victims scrabbling to file civil action lawsuits to try to recoup lost savings. Often they were trying to access the protection fund repaid to the US State by the very pools they had invested through. The big feeder funds themselves were largely covered by the SIPC.

While Madoff maintained he was solely responsible, obviously such a monumental Ponzi scheme involved many players. In subsequent years, a few faced punishment. For example, Frank DiPascali, Madoff’s chief financial officer and Madoff’s secretary, Annette Bongiorno, alongside his operations manager, Daniel Bonventre and accounts manger, Joann Crupi, all served time after related prosecutions. Others were more fortunate, financially speaking.

The investor Jeffrey Picower had grabbed an estimated $7.2B from the Ponzi scheme. As with so many others closely related to Madoff’ fraud, he died unexpectedly shortly after Madoff’s conviction. While his widow was subsequently compelled to forfeit the money, Picower certainly benefited in his own lifetime.

Stanley Chais funnelled his clients investments into the Ponzi scheme for decades. Taking an estimated $1B in profits, the celebrated Israeli philanthropist finally settled a “profit” repayment of $277M.

Norman Levy had been investing in the Ponzi scheme since the 1970s. His estate settled for $220M in 2010. Given the lengthy period of his involvement, this also seems like a rather favourable outcome.

Madoff began his scheme with seed money from clothing entrepreneur Carl Shapiro. Shapiro had been investing with Madoff for 40 years and made a $250M investment only weeks before the scam detonated. Shapiro paid back $625M in total. Picower, Chais, Levy and Shapiro eventually became known as “the Big Four.” Relatively speaking, their “losses,” if they had any, seemed more bearable than most.

Madoff founded the Wall Street firm Bernard L. Madoff Investment Securities LLC (BMIS) in 1960. Like Ponzi, Madoff’s unique selling proposition (USP) didn’t appear too outlandish. He went further than other Ponzi operators to scrupulously maintain plausibility. He gave his scam an air of exclusivity, initially declining would-be investors. He also cultivated his image as a trustworthy philanthropist, donating generously to worthy causes and didn’t offer obviously ridiculous returns.

Claiming that he used a split-strike conversion, or collar, investment strategy, Madoff convinced prospective clients that by purchasing both out-of-the-money (OTM) ‘put’ options and selling ‘call’ options (covered calls) he could assure a steady, low risk 20% annual return on investment (ROI).

If the stock value in Madoff’s portfolio dropped, the purchased put option, forcing a sale at the subsequent above market strike price, would mitigate any losses. If the price rose above the covered call strike price, Madoff’s call option buyers would exercise their right to buy his stocks.

While this would limit profits to the strike price of the covered call, the premium from selling the call options would also fund the purchase cost of the puts. Even for those with some grasp of market finance, it all seemed so believable.

SEC Disinterest

Unlike Howe, Miller and Ponzi, Madoff did not promise instant riches or make conspicuously exorbitant claims. This undoubtedly contributed to the longevity of his grift, but it wasn’t the only reason he sustained the so-called “largest Ponzi scheme in history” for more than two decades.

Sixteen years before Madoff’s flimflam was exposed, the Wall Street Journal (WSJ) reported the US Securities and Exchange Commission’s (SEC’s) investigation of a Florida investment pool, run by the accountants Frank J. Avellino and Michael S. Bienes. The pair were suspected of swindling $440 million out of the Florida community through their A&B trading enterprise.

But when the court appointed auditors checked A&B’s books, the money, at least, was all in place. Technically, the pair didn’t appear to be defrauding anyone. Frank and Michael were taking a profit—effectively a substantial handling fee—after outsourcing their investment strategy to a money manager. That broker was Bernie Madoff.

Madoff had pioneered electronic trading, calling it “artificial intelligence.” In 1992, as the SEC were investigating A&B, BMIS could execute trades faster and cheaper than anyone else. Consequently, BMIS’ daily trade volume was around $740M, representing 9% of all activity on the New York Stock exchange. Despite many years during the 1980s, when market volatility left money mangers struggling to even match the turbulent performance of the S&P 500 index, BMIS were seemingly always able to beat it by some margin.

When the WSJ quizzed Madoff about A&B’s pool, he revealed that he had been operating his split-strike and similar strategies, such as convertible arbitrage, since the late 1970’s. In hindsight, suggesting something closer to a 40 year Ponzi scheme.

A&B’s mistake was not registering the trades with the SEC. Had they done so, then Madoff would necessarily have been listed as their broker. The SEC accused Frank and Michael of running “an unregistered investment company [that] engaged in the unlawful sale of unregistered securities.” Speaking about A&B, Madoff reportedly said “he didn’t know the money he was managing had been raised illegally.” Everyone seemed happy to accept him at his word.

For some reason, despite a lengthy investigation and court orders compelling the A&B to return investors’ money, neither A&B’s lawyers nor the SEC named Madoff. It was the WSJ that reported the identity of A&B’s mysterious money man. Apparently, the revelation didn’t even vaguely pique the SEC’s interest in BMIS.

Ironically—perhaps having read the WSJ article—following the closure of A&B, and now knowing who the duo’s broker was, nearly all of A&B’s clients reinvested their money in BMIS’ split-strike wheeze. As did Frank Avellino and Michael Bienes.

Madoff’s Ponzi scheme had a better USP than any before it. It was a total charade nevertheless. Madoff was following the Ponzi method precisely.

He Madoff was simply depositing his investors money in his account held by Chase Manhattan Bank—later merging into JP Morgan Chase & Co—and paying client redemptions from those funds. The impact of the Ponzi scheme’s collapse was devastating for some, but not everyone. At its peak, Madoff’s account held $5.5B.

The split-strike conversion is a perfectly legitimate approach to investment. It is also a conservative, long term investment strategy unlikely to deliver an annual 20% ROI. In the 1992 WSJ article, the journalists questioned Madoff about the apparent resounding success of BMIS:

[Madoff] insists the returns were really nothing special, given that the Standard & Poor’s 500-stock index generated an average annual return of 16.3% between November 1982 and November 1992. “I would be surprised if anybody thought that matching the S&P over 10 years was anything outstanding,” he says.

This was basically misinformation. Madoff’s claimed split-strike method didn’t explain how he achieved such startling results. There is no evidence that the regulators, the supposed experts in financial fraud, were in the least bit sceptical. On the contrary, they appeared to be going to some lengths to avoid investigating Madoff.

SEC Failure?

The 2008 financial crash was the main contributory factor for the collapse of BMIS. Like all Ponzi schemes, perpetual growth was a prerequisite. When depositors looking for safer havens cashed out, Madoff’s reportedly faced a $7B liquidity crisis with no hope of resolving it.

Madoff confessed to his sons, who were allegedly shocked by the discovery, and they turned their own father in after seeking legal advice. Madoff took a plea deal, supposedly to spare his family further pain. Sadly, that didn’t pan out either.

The SEC didn’t take any serious interest in BMIS until 2008. The 2009 Office of Inspector General (OIG) report into the string of SEC “failures” to investigate found nothing untoward.

The fact that SEC Assistant Director Eric Swanson was closely linked to the Madoff family—in a relationship with Bernie’s niece—was not deemed suspicious. Shana Madoff just happened to be Madoff’s chief compliance officer. Having met in 2003, she and Swanson married in 2007.

Going back to the A&B investigation, between 1992 and 2008, the SEC received six “substantive complaints” and had read two media articles from “reputable publications,”—the WSJ’s piece being one of them—that raised some “red flags” with regard to “Madoff’s unusually consistent returns.”

Determining that, throughout the sixteen year period of “red flags,” the SEC “never took the necessary and basic steps to determine if Madoff was misrepresenting his trading” and that “the SEC could have uncovered the Ponzi scheme well before Madoff confessed,” the OIG found no evidence of any wrongdoing.

Apparently, it was all due to the SEC trusting whatever Madoff told them. The involvement of too many “inexperienced personnel”—who were presumably clueless—was reportedly a problem. A general lack of planning and, as is monotonously usual for this kind of internal investigation, a “systematic breakdown” for which no “senior-level officials” held any sort of responsibility, all contributed to SEC alleged “failure”.

Remarkably, the OIG stated:

The SEC examiners and investigator failed to understand the complexities of Madoff’s trading and the importance of verifying his returns with independent third-parties.

Which rather begs the question what the SEC supposedly does if it can’t “understand the complexities” of financial market trading. But are there any other reasons why the SEC may have been averse to upending BMIS?

A Very Useful Ponzi Scheme

BMIS was a major third market trading provider. It was acting as a “market maker,” providing liquidity to finance the over-the-counter (OTC) trade in securities between large institutional investors. While these securities are “exchange-listed” they are not traded through the big stock exchanges, such as the New York Stock Exchange.

The third market provides a level of anonymity and excludes some public information normally required for trading on the major exchanges. It is where big institutional investors go to to conduct quick business, typically buying and selling large blocks of company shares. They use the third market for their own benefit, rather than acting on a clients behalf.

BMIS was one of the largest, many say “the” largest, market maker on Wall Street. As such, BMIS might, for example, buy a large block of shares off a major investor for cash. Thus enabling large institutional investors to quickly liquidate significant stock holdings, without needing to finalise a buyer.

As noted by the Dubai bases investment “incubator,” FasterCapital:

Third market makers play a crucial role in enhancing market liquidity by providing a constant stream of buy and sell orders. Their presence ensures that there is always a counterparty available for traders, regardless of the prevailing market conditions. [. . .] By doing so, they help stabilize the market and ensure that trading can continue even in turbulent times.

Madoff’s Ponzi Scheme was a vital source of liquidity for global financial markets.

Apparently, this had nothing to do with the SEC’s peculiar Madoff blind-spot. We are asked to believe that US regulators were oblivious to an enormous Ponzi scheme run by one of Wall Streets leading firms for more than 20 years. BMIS key role in shoring up unsteady global markets had nothing to do with it, or so we’re told.

When it all came crashing down, Bernie Madoff’s $7B liquidity trap was nothing compared the hole the rest of the financial system found itself in.

Genuinely The Biggest Ponzi Schemes In History

When researchers from the University of Louisiana at Lafayette looked into Madoff’s Ponzi scheme bank account, they reported:

Assuming that the deposits returned the bank’s net interest margin and grew at a random geometric rate, this paper estimates that JP Morgan Chase generated $435 million in after-tax profits from this very large account over the course of sixteen years.

Eventually, JP Morgan Chase & Co (JPMC) agreed to pay the US government a $2.6B settlement—for a deferred prosecution agreement—and admitted “negligence.” Subsequently, JPMC were able to resist a lawsuit from the “net winners” of Madoff’s schemes who accused JP Morgan of direct complicity.

The Judge cited JPMC’s admitted negligence in his ruling, observing that negligence did not amount to fraud. The investors not covered by the SPIC lost again. Like everyone else with oversight of Madoff’s activities, JPMC maintained it didn’t have a clue, although conceded it could have been more diligent.

For major commercial banks like JPMC $2.6B isn’t chicken feed, but nor is it back breaking. Immediately, following the 2008 financial crash, caused by the wild speculation in the financial derivatives market, the US government agreed to inject $250B of capital into the commercial banks. This was in addition to the $700B purchase of the banks junk assets and a senior debt underwriting package worth $1.5T (trillion), including $500B deposit assurance for business accounts. This amounted to an initial $2.45T bank rescue mission in the US alone.

We’ll stay focused on the US here, but we shouldn’t forget that what happened in the US was emulated in many nations. The story behind the global 2007/8 crash is well known but worth briefly reiterating.

Mortgage Backed Securities (MBS) are securities traded in the derivatives market. An MBS is a fixed-income security based upon the interest payments due on the pooled mortgages it contains. The underlying asset of an MBS is the accumulated bundle of mortgage agreements.

The early to mid-2000s saw rapid property price rises in the US. Combined with plummeting Fed’ Fund interest rates, that stayed relatively low until mid decade, the commercial banks were throwing money at anyone who claimed they could afford to make the repayments. This included lending to the subprime market catering for people with low credit scores. Often these were interest only mortgages and not just household mortgages either. Colaterall loans on commercial, industrial and agricultural property were often pooled with residential mortgages in MBS.

Subprime lending to house buyers, setting higher mortgage rates, was particularly lucrative. If the borrowers defaulted, the banks could repossess, make the family homeless, and sit on tidy property portfolios. As long as the housing market remained buoyant.

The minimally regulated investment banks were operating hedge funds, trading MBS and other securities in the derivatives markets. Thus, as commercial banks also operated investment arms, they were increasing demand for their own mortgage lending. They were inflating the housing bubble and stimulating their own high risk, subprime lending.

The ratings agencies, who have a conflict of interest because they are paid by the banks, gave nearly all the MBS triple ‘A’ (AAA) ratings, including MBS stuffed with subprime mortgages. Consequently institutional investors were eager to trade the supposedly safe “residential mortgage backed securities” (RMBS).

This trade was again fuelled by the commercial banks who continued to imprudently shower cheap money on investors enthusiastically speculating with MBS. Trade was done over-the-counter (OTC), ably assisted by, among others, Bernie Madoff, who offered institutional investors additional liquidity whenever they wanted to pounce on an MBS opportunity.

To complicate matters, other financial derivatives, based solely or largely upon MBS, such as Collateralized Mortgage Obligations (CMOs) and Collateralized Debt Obligations (CDOs), were also being liberally traded.

Stoking things further, the commercial banks had been selling Credit Default Swaps (CDS), to mitigate potential MBS risks, for years. CDS buyers generally pay a regular premium to the seller in exchange for a purchase agreement of the security and interest due, if a “credit event” occurs. A “credit event” for an MBS would be triggered if the mortgage holders defaulted.

What’s more, the CDS are also derivatives that can be traded. Many institutional MBS investors bought CDS from commercial banks, or other sellers, then resold the CDS to other investors for marginal profit in the derivatives market. The CDS model of insurance cover for MBS speculation encouraged the ratings agencies to issue AAAs on MBS with very limited scrutiny of the underlying assets; the subprime mortgages.

So immense was subsequent derivative trading in CDS, by 2007, CDS constituted the largest single asset pool in the world. The estimated global CDS pool value was $62.2T. What happened next would wipe $35.9T of CDS “value” off the financial markets in two years.

Starting in 2004, the Fed Fund rate began to rise. This corresponded with the end of many subprime borrowers initial mortgage agreements. As they looked to remortgage they couldn’t meet the new rates and mortgage delinquency, defaults, repossessions and household debt rose sharply. The US housing bubble popped, resulting in widespread economic pain and years of austerity.

As with the demise of Madoff’s Ponzi scheme, some investors fared markedly better than others. As usual, it was the small time depositors, homeowners and the public who bore the brunt of the financial misery.

In all likelihood, the precursor to a global financial collapse wasn’t as bad as many feared. Subprime mortgages were the underlying assets in a relatively small percentage of MBS. The real problem, once again, was the “complexity” in the derivatives market.

The 2011 US government Financial Crisis Inquiry Report noted:

OTC derivatives rapidly spiralled out of control and out of sight, growing to $673T in notional amount. [. . .] OTC derivatives contributed to the crisis in three significant ways. First, one type of derivative—credit default swaps (CDS)—fuelled the mortgage securitization pipeline. CDS were sold to investors to protect against the default or decline in value of mortgage-related securities backed by risky loans. [. . .] [W]hen the housing bubble popped and crisis followed, derivatives were in the center of the storm. [. . .] [M]illions of derivatives contracts of all types between systemically important financial institutions—unseen and unknown in this unregulated market—added to uncertainty and escalated panic.

When the music stopped, the interweaving network of MBS, CMOs, CDOs and CBS, combined with the relative anonymity of OTC trading, left investors, banks and regulators alike, unable to identify where the exposure lay. No one could figure out who was holding junk bonds and who wasn’t. Consequently, as demand simply stopped, the investment banks were left holding mountains of toxic assets.

While the reason to panic was perhaps not as acute as assumed, panic ensued nonetheless. The global derivatives market is almost entirely dependent upon investor confidence. Without it, regardless of their notional value, the multitude of MBS related financial instruments were relatively worthless. Taking the knock-on financial impacts into account, the final cost of all this, just to the US economy, was practically incalculable.

According to Harvard Business Review, in 2018 a reasonable total loss estimate was somewhere in the region of $4.6T. As conservatively estimated by the Federal Reserve, this effectively meant that every US citizen paid $70,000 into the derivatives scam. The cost of the bank bailouts alone forced every US taxpaying citizen to become an “investor,” whether they wanted to be one or not.

So let’s review how a truly gargantuan Ponzi scheme operates.

If done with any aplomb, the USP seems plausible. This attracts a multitude of investors who think they are investing in a real financial plan. In reality, the underlying assets are junk and they are actually receiving payments from everyone else “invested” in the scheme.

That is exactly how the 2008, derivatives market financial scam played out. So no, Bernie Madoff’s Ponzi scheme wasn’t even close to being “the largest Ponzi scheme in history.” It was a bit player in the colossal global financial fraud that dwarfed it.

But this still wasn’t the largest Ponzi scheme in history.

As noted in the 2011 Crisis report, in 2008 the notional amount of “money” invested in OTC derivatives was $673T. US GDP in 2008 was around $14.5T. Global GDP in the same year was about $61T. How could anything on the planet have a notional “monetary” value more than ten times larger than the monetary value of the entire productive economy of the Earth?

The answer is that the global fiat currency monetary system is the mother of all Ponzi schemes.

All of us, invest in it with our labour. But there is no intrinsic value underpinning that currency. Thus, its supply can expand without limit, making is seemingly possible to notionally value a tranche of derivatives far beyond the value of the entire global economy.

Via such mechanisms as inflation, the early investors, those who first grab the issuance of new “money”—the commercial banks—cash out thanks to a transfer of wealth from all of us, to them.

As demonstrated by Professor Richard Werner in his 2014 paper titled “Can Banks Individually Create Money Out of Nothing,” banks create fiat currency from nowhere whenever they make a loan.

Some will argue that fractional reserve banking limits this process. The problem with this is that central banks create reserves in exactly the same manner. For example, according to the Bank of England (BoE), Quantitative Easing (QE)—which pushed the global money supply to literally climb off the charts—operates as follows:

Quantitative easing involves us creating digital money [. . .] to buy things like government debt in the form of bonds […] By creating this ‘new’ money, we aim to boost spending and investment in the economy.

This new “digital money” didn’t exist until the central bank made it appear with a wave of its financial wand. Just as the commercial banks conjure broad money from nothing, the central banks create the same “fairy dust”—as Werner called it—when they magic reserves, or base money, out of the ether.

The BoE adds that they also “use this new money to buy bonds from the private sector.” Imagining money into existence simultaneously creates reciprocal debt. The BoE gives an example of how this mythological financial system operates:

Suppose we buy £1 million of government bonds [with fairy dust] from a pension fund. In place of the bonds, the pension fund now has £1 million in money. Rather than hold on to this money, it might invest it in financial assets, such as shares, that give it a higher return. And when demand for financial assets is high, with more people wanting to buy them, the value of these assets increases.

Asset “value” certainly increased prior to the collapse of the 2008 global Ponzi scheme. Not only was the assumed value speculative, to the point of being baseless, the purchases were made with “fairy dust.”

All of this manufactured debt and the profits that a select few glean from it, is ultimately paid by us, the taxpayers. We are the unwitting investors. As savers, small businesses and working families lose purchasing power, household debt accrues. Aided by ever escalating national debt ceilings, the institutional investors and the banks, as industry partners of government, just keep going.

There is nothing “real” about the global monetary system Ponzi scheme. While supply and demand, and basic economic principles like “value,” still apply, the financial system outstripped the “real economy” and headed off to Neverland half a century ago.

Following the 2008 financial crash—they largely caused—the commercial banks continued to plough their taxpayer underwritten fairy dust into the derivatives market. Generating ever more nymph-fuelled debt for the real global economy and hoovering up more profits along the way. Between Q3 2008 to Q3 2010, major US banks increased their total notional derivatives exposure from approximately $175T to nearly $235T.

No one really knows how big the “notional” value of the current derivatives market is. Some say more than $1 quadrillion. The Bank for International Settlements (BIS) stated:

The notional value of outstanding over-the-counter (OTC) derivatives rose to $632T at end-June 2022 [. . .]. The gross market value of outstanding OTC derivatives, summing positive and negative values, rose noticeably in the first half of 2022, to $18.3T.

In Ponzi scheme terms, this is tantamount to saying the collapse of the derivatives market would leave a nominal debt-owed hole in the global economy of $632T. The principle risk is $18.3T.

To be frank, precise calculations of the scale of derivative funny money speculation are somewhat irrelevant. Suffice to say, there are monstrous sums sloshing around in high risk derivative Ponzi schemes that can only exist thanks to debt based money printing. Usury in other words.

If investors lose confidence and try to cash out of the derivatives market, the whole house of card will crash. It will take everything with it, again.

Of course, hedge fund profits are also paid in magic money, but that doesn’t matter to the grifters. As long as we all carry on believing the so-called “money” is real, we will continue to traipse off to work to pay for it all. Thereby, allowing the profiteers to convert their sparkles into real assets. Mansions, yachts, huge tracts of farmland, weapons factories, gold and Bitcoin, for example.

Bitcoin Is Not A Ponzi Scheme

Satoshi Nakamoto’s began work on Bitcoin in 2007, before the global financial crash took shape. That said, to a great extent, whoever the pseudonymous Nakomoto may be, they nevertheless offered a potential solution to the fiat monetary Ponzi scheme. Shortly after the Bitcoin genesis block was mined, in 2009 Nakomoto wrote:

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. [. . .] With e-currency based on cryptographic proof, without the need to trust a third party middleman, money can be secure and transactions effortless.

The Cypherpunks had been working on the “financial sovereignty” problem for nearly two decades prior to the publication of Nakomoto’s white paper. They were wrestling with complex cryptographic problems like how to independently timestamp transactions on an electronic ledger and how to overcome the problem of “double-spending”—using the same unit of digital currency repeatedly—without reliance upon some third party verifying transactions. The Cypherpunks were trying to cut out the banks.

Building on the earlier work of Cypherpunks like David Chaum, Nakamoto’s elegant distributed ledger technology (DLT) solution was truly unprecedented: something new under the sun.

In 2009 Nakamoto wrote:

Bitcoin’s solution is to use a peer-to-peer network to check for double-spending. In a nutshell, the network works like a distributed timestamp server, stamping the first transaction to spend a coin. It takes advantage of the nature of information being easy to spread stifle but hard to stifle.

Though Nakamoto didn’t use the phrase “blockchain” that is what was outlined in the white paper:

The solution we propose begins with a timestamp server. A timestamp server works by taking a [cryptographic] hash of a block of items to be timestamped and widely publishing the hash [. . .]. The timestamp proves that the data must have existed at the time, obviously, in order to get into the hash. Each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it.

Bitcoin is a peer-to-peer (p2p) electronic currency issued and signed via cryptographic algorithms. Cryptocurrencies are separate and distinct from other forms of “digital currency.” The network of nodes accept proof-of-work (PoW) consensus rules to validate and broadcast transaction on the network. The nodes are widely distributed, each carrying a complete record of the networks transaction history. They do not require “permission” to validate PoW on the network (blockchain – DLT).

Bitcoin is a p2p cryptocurrency that operates on a decentralised, permissionless blockchain. This means, it can be used by people around the world to make international remittances without the need of any third party, such as a bank or a payment service provider. All they need is internet access.

If we take Bitcoin to be a functioning currency—a medium of exchange for goods and services—and if we also accept Satoshi Nakamoto’s vision of decentralised peer-to-peer permissionless network ledger (permissionless blockchain), can Bitcoin legitimately be called a Ponzi scheme?

Let’s revisit Jorge Stolfi’s Ponzi scheme definition.

You can invest in Bitcoin, expecting good profits, but only of your intention is to trade it and not use it as a currency. As a currency, there are no trade profits to “cash out.” You earn it and spend it as you would with any medium of exchange (currency).

One of the criticisms of Bitcoin, and other cryptocurrencies, is their valuation volatility, measured in fiat currencies such as the US dollar. Certainly, if you bought enough Bitcoin in 2009 and cashed out today you would have made a striking above inflation “profit.” But that all depends upon the intrinsic “value” of Bitcoin.

In a Ponzi scheme there is no external source of revenue to cover “payoffs.” But this is a moot point with regard to Bitcoin. Bitcoin doesn’t need external sources because it is a currency with intrinsic value and there are no payoffs (unless you are trading it).

Any payoffs traders take are usually paid in fiat currency. While the traded Bitcoin needs a buyer, no Bitcoin is actually removed from the p2p network (blockchain). To this extent there is no “new investment money” merely a transfer of ownership of the existing currency.

Price fluctuation is a reflection of Bitcoins intrinsic value. This may be altered, up or down, by trader activity but it is not a function of Bitcoin. It is a consequence of trading Bitcoin as one might on the Foreign currency exchanges (Forex). Traders gather fiat fairy dust by trading Bitcoin between themselves.

No one is taking large portions of Bitcoin “away.” Bitcoin mining, using computers to verifying PoW, is time and effort (work) paid in Bitcoin.

Bitcoin is not a Ponzi scheme. It is a currency. Unlike fiat currency fairy dust, it is not created out of nothing. Real work—Bitcoin mining—“earns” Bitcoin and adds it to the blockchain.

Satoshi established Bitcoin in 2008, the same year the global financial crash took hold. Nakamoto limited the total maximum supply of Bitcoin to to 21M BTC. There is a lot of debate about why the 21M figure was set. Some say it is a mathematical function of the BTC protocol, others that the intention was to create scarcity and thus render BTC a store of value. Consequently people sometimes refer to it as “Bitcoin gold.”

Mediums of exchange (currencies) are only “worth” whatever value we place on the goods and services we can buy with them. In 2024, goods and services that cost £130.55 sterling could have been purchased for $10 in 1970. This is a product of inflation—which literally means inflating the money supply—and represent a massive erosion of purchasing power. Fiat fairy dust is an appalling store of value. With seemingly unlimited magical supply, its depreciation is phenomenal.

The current fiat currency based monetary system, concentrates wealth, and ultimately political authority, in the hands of those invested with the mystical power to create money out of nothing—the central and commercial banks. Bitcoin, or more more specifically the DLT it is based upon, offers the world the possibility, not just of a new monetary system, but of a new economic paradigm: decentralised finance (DeFi).

When the money printing presses are controlled by a select few, they can “gatekeep” who enters the marketplace and who doesn’t. They pick the winners and losers and have consequently constructed a global public-private partnership (G3P) designed to consolidate their network’s global power and influence. Decentralised and permissionless DLT based DeFi defies G3P power.

For example, by putting up your BTC as collateral, you can create a “smart contract” to locate funds pooled on the DLT to raise investment capital without any recourse to a third party, such as a bank. While such DeFi is currently a nascent and unrefined financial technology (FinTech)—and presently high risk—the potential to stimulate entrepreneurship, scientific and medical research and much more, absent any centralised control, could benefit humanity greatly.

If Bitcoin is to be scaled as a functional, global currency, then the “layer 2” blockchain solutions, such as the Lightening Network, are an unavoidable necessity. This does not mean that Bitcoin cannot remain a permissionless, decentralised currency, but it increases the chance of centralisation and control.

While the Bitcoin community battles to ensure that doesn’t happen, it is under attack from “off-chain” actors. They view Bitcoin as a tantalising USP for their beloved fiat Ponzi Scheme.

The Bitcoin Ponzi Scheme Paradox

Returning to the observations of Shan Zhiguang and He Yifan, they suggest that the Ponzi scheme can be extended beyond the fraudulent accumulation of currency:

They no longer only revolve around cash, but are also disguised as equity. This type of Ponzi scheme can be classified as an “equity type”, which has three main characteristics: first, it is based on equity that can be valued; second, the equity can be traded; finally, and most importantly, this equity is not related to any asset, productive labor or social value, but is completely made up out of thin air.

Now imagine if, instead of basing your Ponzi Scheme on equities, you create a security that tracks the performance of an underlying asset (commodity) that you can trade many times a day. You then offer investors an “equity type” Ponzi scheme using this USP. A Bitcoin Exchange Traded Fund (ETF) would seemingly fit the bill.

A few weeks ago the US SEC approved spot Bitcoin ETFs. BlackRock responded immediately and publicised its iShares Bitcoin Trust (IBIT). BlackRock state:

IBIT can help remove operational burdens associated with holding bitcoin directly, as well as potentially high trading costs and tax reporting complexities. BlackRock is the world’s largest ETF manager by AUM, managing $3.5T in global ETF investment vehicles as of December 31, 2023.

BlackRock chairman Larry Fink was understandably effusive about IBIT. Speaking to CNBC, shortly after the SEC decision, Fink spelled out what BlackRock have in mind:

I do believe it [Bitcoin] is an alternative source for wealth holding. I don’t believe it is ever going to be a currency, I believe it’s an asset class. [. . .] [Bitcoin] is no different from what gold represented over thousands of years. It is an asset class that protects you. What we’re trying to do is offer and instrument [Bitcoin ETF] that can store wealth. [. . .] We’ve changed the architecture of our firm. [. . .] ETF’s are step one in the technological revolution of financial markets. Step two is going to be the tokenisation of every financial asset. [. . .] We’re looking at Bitcoin, we’re looking at ETF in the same manner. These are technological changes that are going to allow us [BlackRock] to move forward.

BlackRock has been earnestly pursuing ETF opportunities since its pivotal 2009 acquisition of Barclays Global Investors (BGI). Nonetheless, given its architectural transformation, SEC regulatory approval was very “fortuitous” for BlackRock. Luckily, the “independent” SEC made the right choice at the right time for BlackRock.

SEC Bitcoin ETF licensing was met by apparent dismay from the European Central Bank (ECB). The influential City of London linked UK Financial Times practically laughed in the ECB’s face:

[. . .] nobody in the year of our Lord twenty twenty four really cares what the ECB says about Bitcoin.

The ECB is currently pumping about €980B of flaky Euro denominated fairy dust into European financial markets. With around $10T of assets under management, BlackRock—the world’s largest asset management company—doesn’t really care what the ECB thinks either.

A new derivatives ecosystem is being constructed on the back of the spot Bitcoin ETFs. Perhaps unsurprisingly, the “covered call” is being utilised again. The world’s largest crypto asset manager, Grayscale, has already launched its $23.5B Bitcoin Trust Covered Call ETF.

Like any Ponzi scheme “irrational exuberance” on the part of prospective investors is required. Off the back of the SEC decision, ARK Invest CEO Cathie Woods predicted a “minimum” projected Bitcoin price of $600,000 and an optimistic price of $1.5M by 2030.

Just as Madoff’s scheme was theoretically plausible, so BlackRock’s and other institutional investors’ Bitcoin ETF trading may well realise the corresponding valuation. But it won’t be a reflection of the true “worth” of any underlying asset—Bitcoin. It will be the product of nothing but speculation, “completely made up out of thin air.”

How can the fiat currency Ponzi scheme have survived for so long without being exposed? Why haven’t populations rebelled against the inflationary wealth transfer from them to, what we might call, a financial parasite class.

As pointed out by Mark Goodwin, in “The Birth of the Bitcoin-Dollar,” by effectively tying the world’s leading reserve currency—the US dollar—to oil prices, and then making often violent manoeuvres to largely control oil production and the energy market, The US dollar, and its economy, enjoyed what former French President Valéry Giscard d’Estaing called an “exorbitant privilege.”

Foreign governments need for dollars allowed the US monetary Ponzi scheme, and thus the world’s, to continually expand. There was a constant stream of new investors. Sure, the effect was to push national sovereign debt beyond the point where, for instance, the US economy can pay it, but that didn’t matter as long as the investors kept rolling in. It’s a Ponzi scheme, not a real monetary system.

But all things “too good to be true” come to an end. The global commitment to sustainable development, shifting the global debt based economy’s underlying asset from oil to carbon, and the rise of the multipolar world order, shortening supply chains and redistributing global energy flows, has added pressure to the dollar reserve system. But the grifters aren’t willing to simply give up on their fiat Ponzi scheme. They are instead constructing a global synthetic fraud. Bitcoin evidently has a significant role to play in their schemes.

It is Bitcoin’s potential as a store of value that raised the likelihood of it becoming the basis of the new—or ongoing—fiat monetary Ponzi scheme. Now, through its Bitcoin ETF scam, the parasite class is shifting to Bitcoin as the new gold. A virtual gold standard, if you like.

Goodwin wrote:

We [the Bitcoin community] have recreated the petroldollar mechanisms that allow a retention of net purchasing power for the U.S. economy despite monetary base expansion. [. . .] [T]here will never be more than 21 million bitcoin. [. . .] [B]itcoin is the only commodity to break the pressures of increasing demand on inflating supply. Bitcoin is the only decentralized financial model in existence. [. . .] The world economy now finds itself irreversibly changed by the dawn of the bitcoin-dollar era.

There is a Bitcoin Ponzi scheme paradox. While BTC is not a Ponzi scheme, exploited as a commodity, it is fast being transformed into the claimed basis for the continuance of “the largest Ponzi scheme in history”: the fiat currency monetary system.

The vast majority in the Bitcoin community want to see Satoshi’s vision realised. Unfortunately, such egalitarian aspirations are something else global investment institutions like BlackRock don’t care about.