China’s banks face insolvency risks with widespread mortgage boycotts. The U.S. dollar is strengthening and bringing bitcoin down in the process.

“Fed Watch” is a macro podcast with a true and rebellious bitcoin nature. In each episode we question mainstream and Bitcoin narratives by examining current events from across the globe, with an emphasis on central banks and currencies.

Listen To The Episode Here:

Kuppy is pointing out that the percentage of hedge fund portfolios that are holding cash is higher than any period since the dot-com bubble back in 2000. When these peaks happen and hedge funds rotate back into stocks, the market bottoms and has a nice rally.

We can also see this effect in the bitcoin market.

This chart is a little busy, but the top panel is the “stablecoin dominance,” as I’ve called it, the ratio between the stablecoin market cap and bitcoin’s market cap. It is a proxy for a “cash position” in the bitcoin market. The bottom panel is the bitcoin price. At relative tops in the stablecoin ratio, bitcoin bottoms in price because those stablecoins can rotate into buying bitcoin and vice versa.

The U.S. Dollar

There has been a lot of talk about the strengthening dollar. We are the only bitcoin podcast that unequivocally called for a strong dollar over the last two years, and boy have we been right on that.

I do not expect the dollar to sell off dramatically after its parabolic rise, but to establish a new higher range, perhaps between 100-115 on the U.S. Dollar Index (DXY).

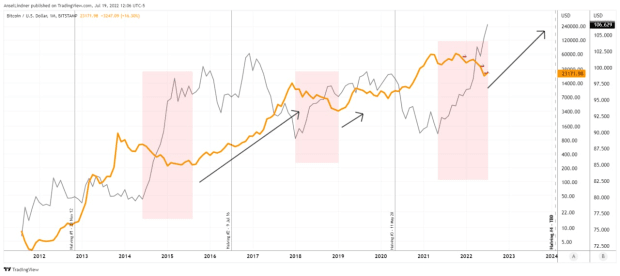

I stress that bitcoin does not need a weakening dollar to explode higher. In fact, if you look at the history of bitcoin charted with the DXY, you can see the dollar establishes a new higher range where bitcoin does sell off. After periods of a rising dollar, bitcoin tends to take off. I didn’t have a chart prepared to show this during the live stream, but it’s included below.

The pink zones indicate periods of rising dollar and falling bitcoin. The black arrows indicate rising bitcoin amid a steady dollar at a higher range. Important to note, bitcoin and the dollar have both stair-stepped higher over the last 10 years, only on slightly different schedules.

Last, we take a look at the euro and discuss how and why it is in the most trouble out of the major currencies. We mention fragmentation risk several times. I did a podcast episode dedicated to that topic recently.

Please check out the Fed Watch Clips channel on YouTube, subscribe and share.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.